Are you interested in day trading? If so, you may have come across the term “pattern day trading rules.” These rules are important to understand if you want to engage in day trading on a regular basis.

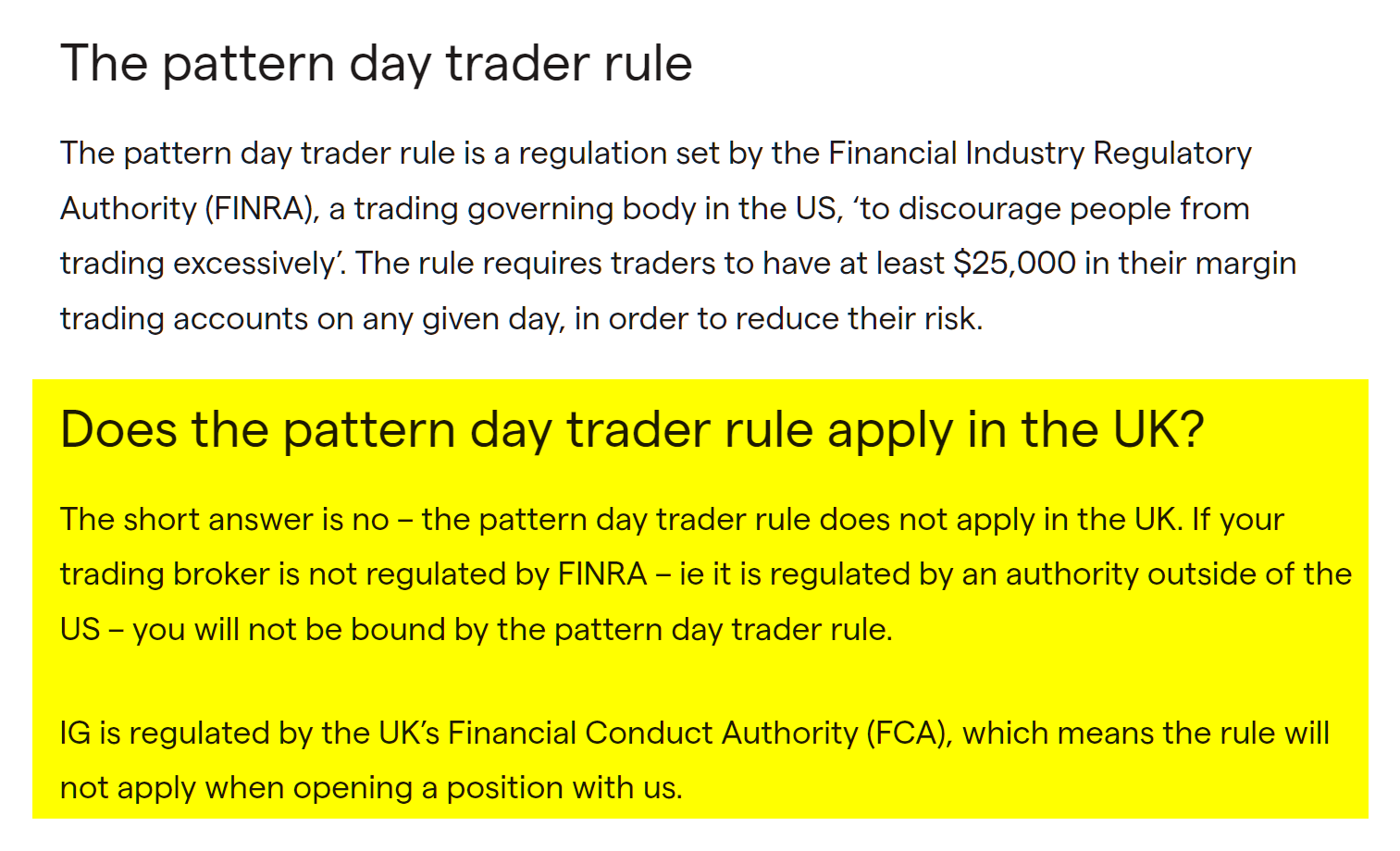

Pattern day trading rules are regulations set by the Securities and Exchange Commission (SEC) to protect retail investors. Essentially, these rules require traders to have a minimum account balance of $25,000 if they make more than three day trades in a five-day period.

pattern day trading rules

Understanding Pattern Day Trading Rules

If you fall under the category of a pattern day trader, you must maintain the $25,000 minimum equity requirement in your account at all times. This ensures that you have enough capital to cover potential losses and meet margin calls.

Additionally, pattern day traders are subject to certain restrictions, such as not being able to make trades using borrowed funds or leverage. These rules are in place to reduce the risk of day trading and protect investors from excessive losses.

It’s essential to educate yourself on pattern day trading rules before diving into day trading. By understanding these regulations, you can better manage your trades and account balance to comply with the SEC’s requirements.

In conclusion, pattern day trading rules play a crucial role in regulating day trading activities and protecting investors. By following these rules, you can trade more responsibly and minimize the risks associated with day trading. Remember to always stay informed and stay compliant to ensure a successful trading experience.

Pattern Day Trader Rules PDT Equity Maintenance Calls EM YouTube

Pattern Day Trading The Pattern Day Trading Rule ClayTrader

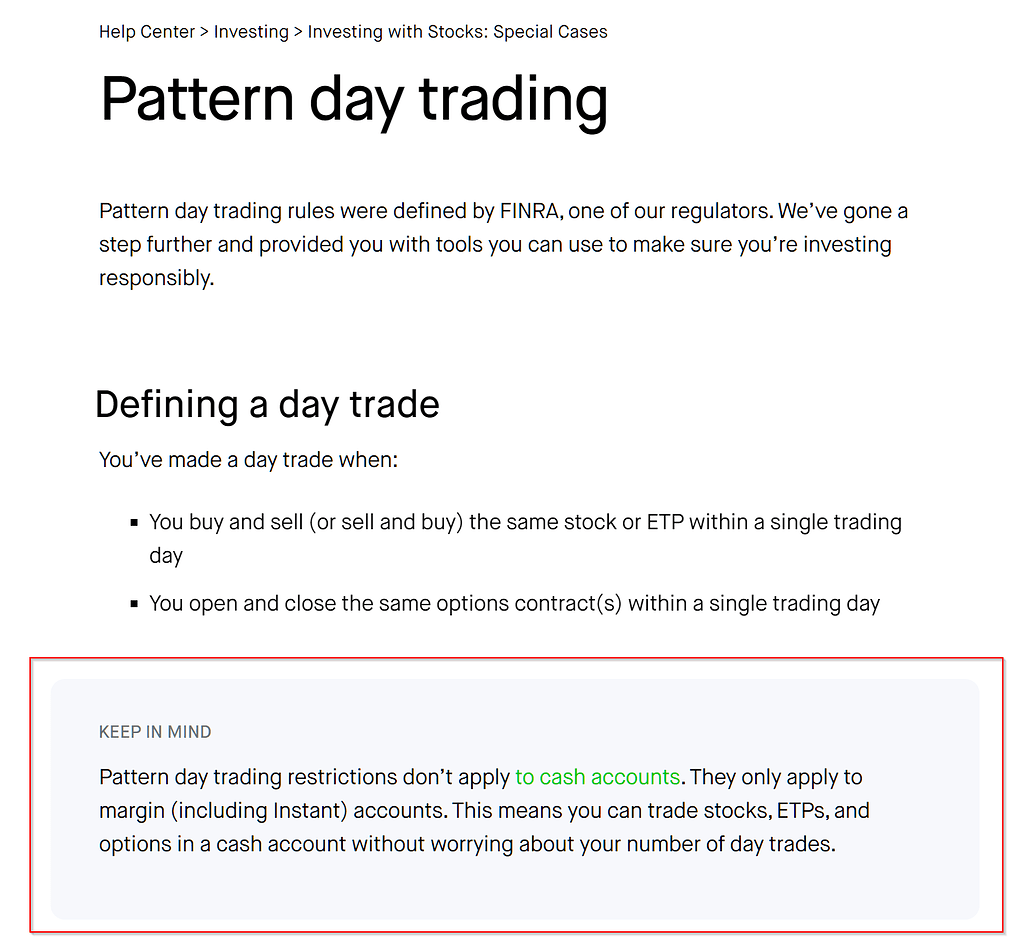

Cash Account To Avoid Pattern Day Trading Rule Getting Started With Alpaca Alpaca Community Forum

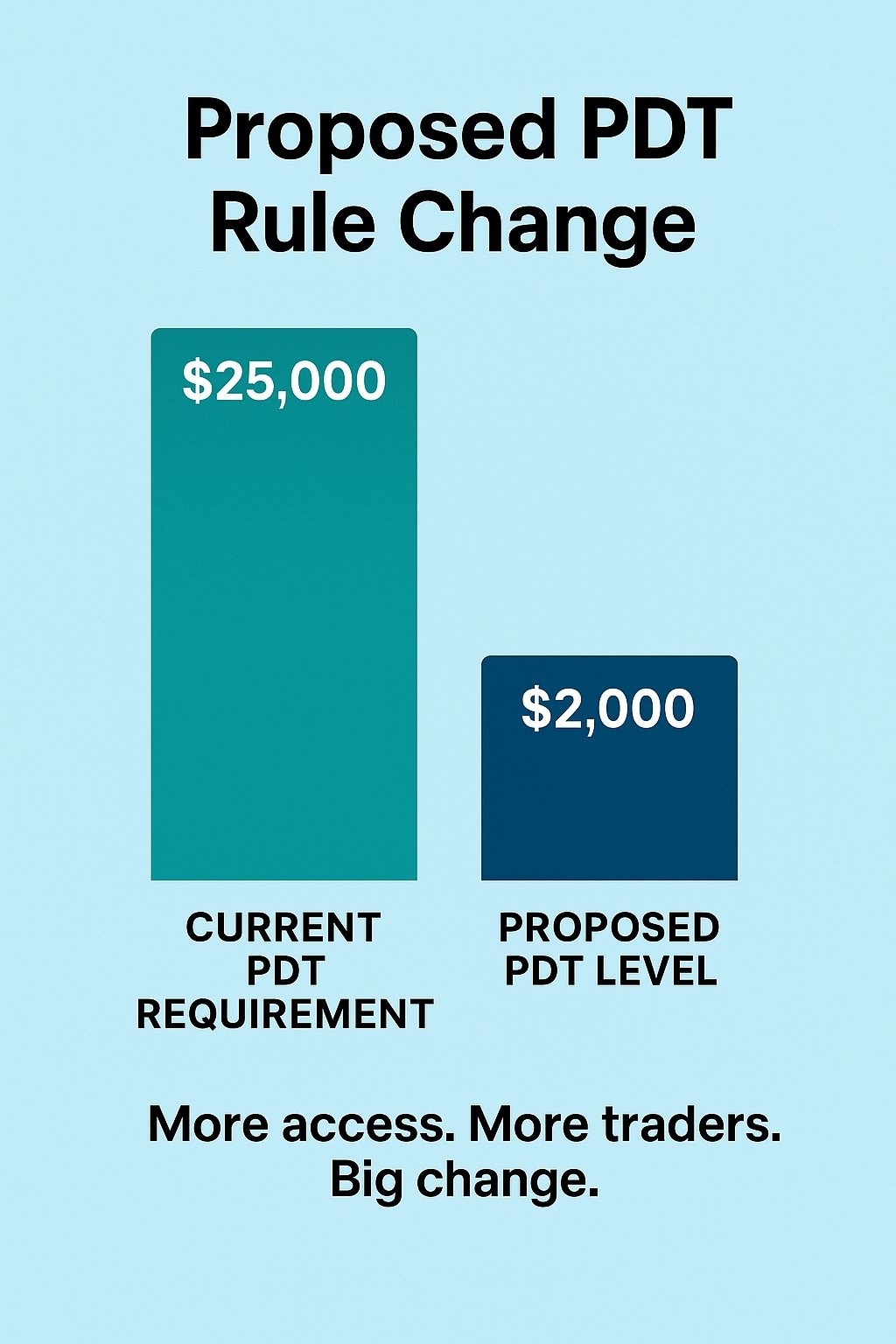

PDT Rule On The Brink Of Historic Overhaul Potentially Lowering Entry For Day Traders Cyber Trading University

Cash Account To Avoid Pattern Day Trading Rule Getting Started With Alpaca Alpaca Community Forum