Have you ever heard of the shooting star candlestick pattern? If you’re new to trading or investing, this term might sound a bit daunting, but fear not! We’re here to break it down for you in simple terms.

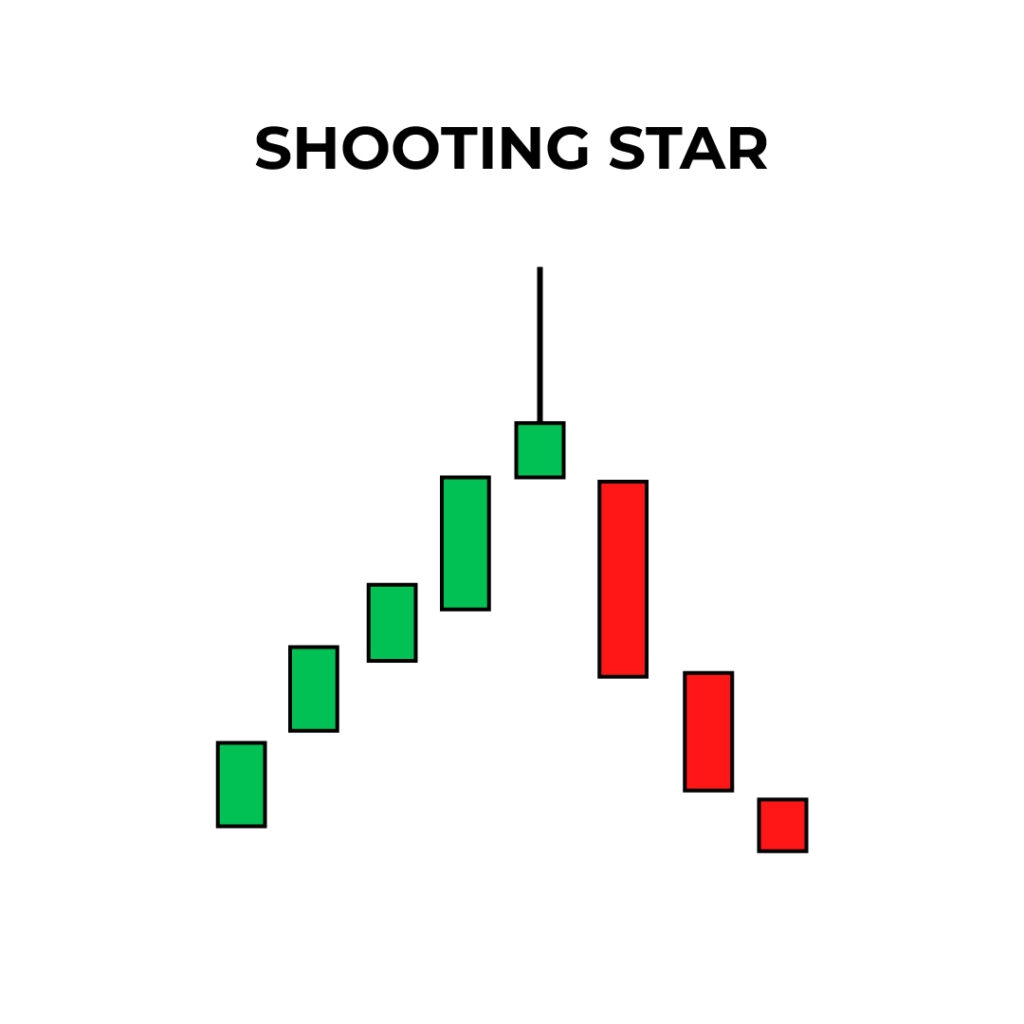

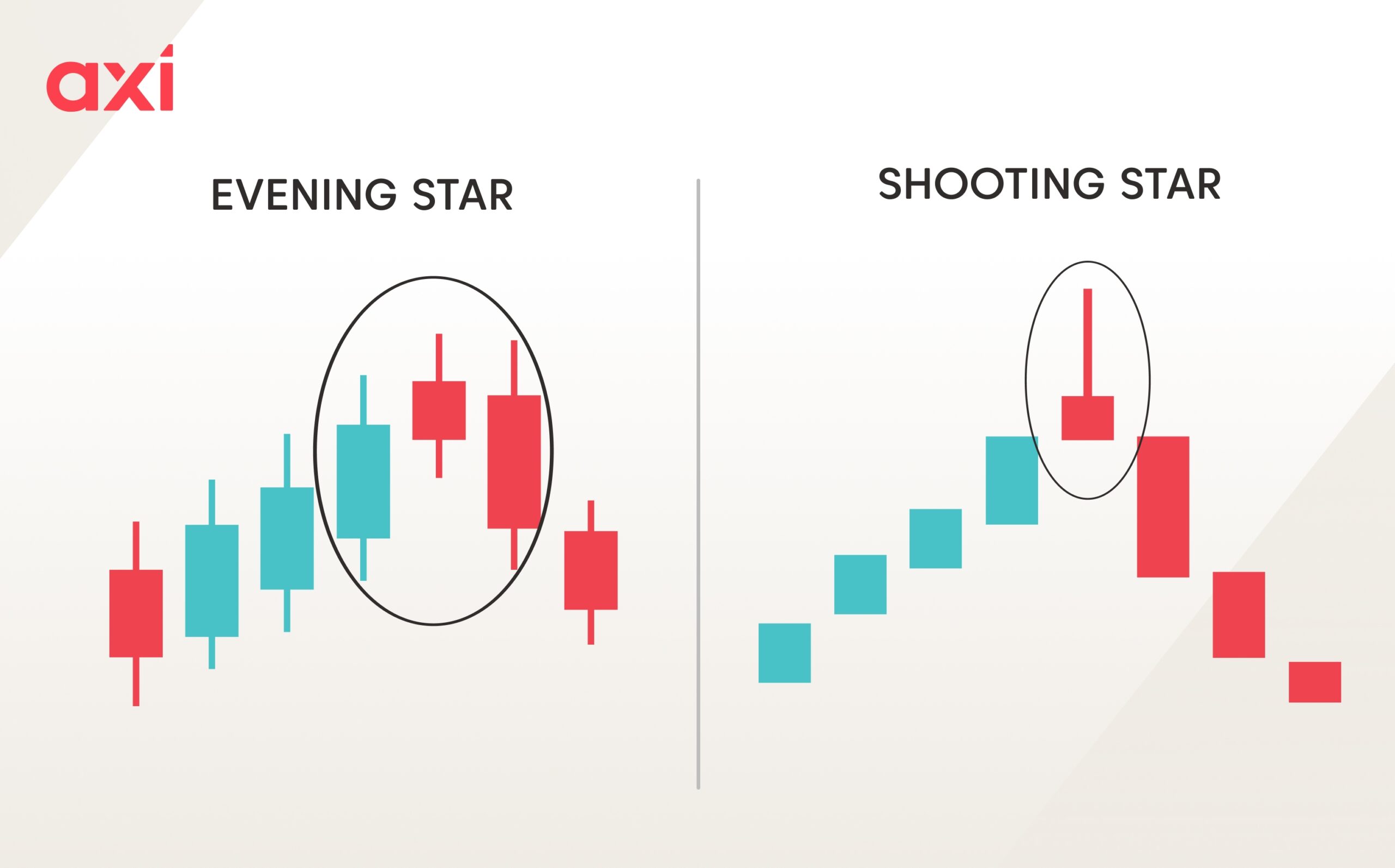

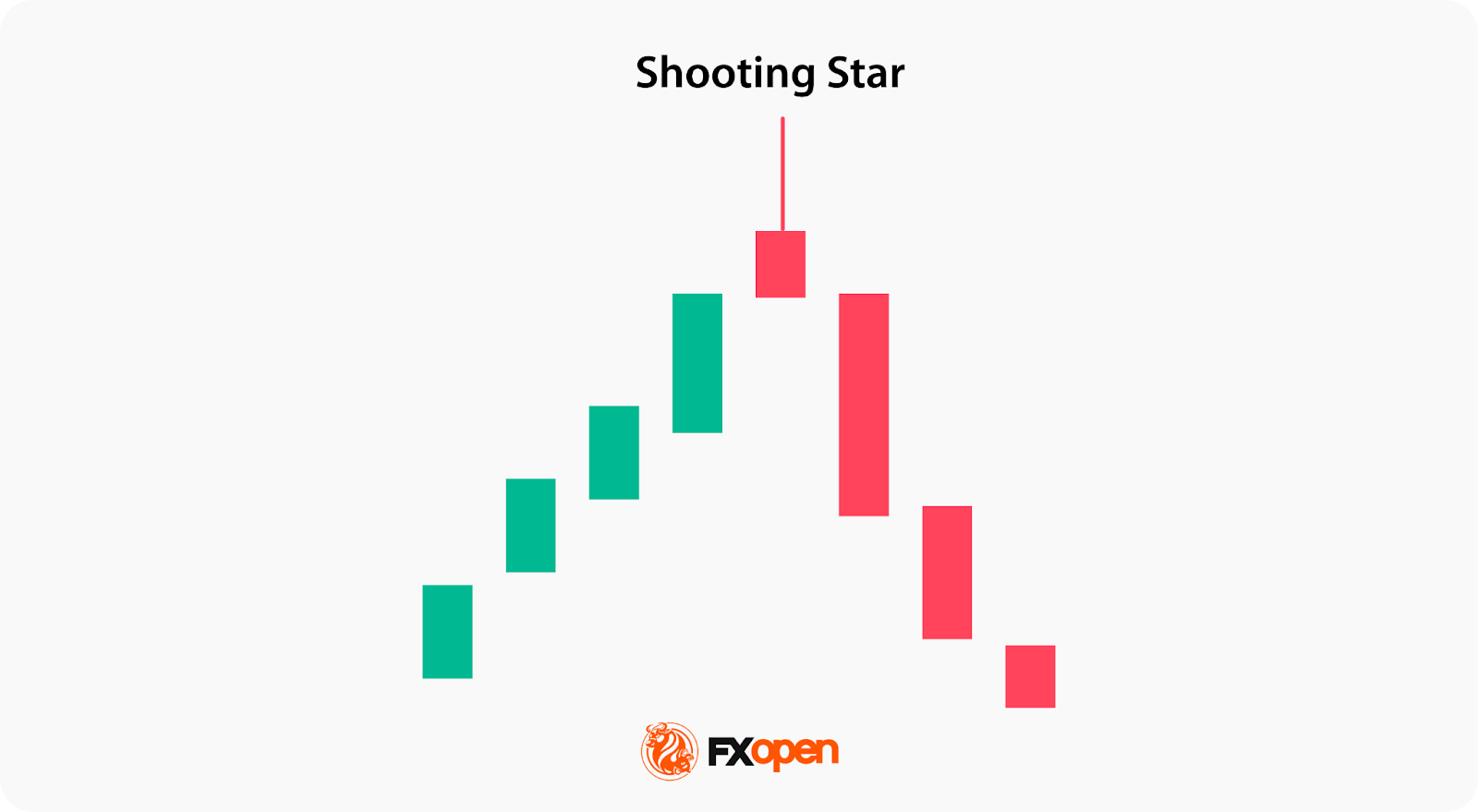

The shooting star candlestick pattern is a popular chart pattern that indicates a potential trend reversal. It looks like a small candle with a long wick on top and a small body at the bottom. This pattern suggests that buyers pushed the price up during the trading session, but sellers took control and pushed it back down by the close.

shooting star candlestick pattern

Understanding the Shooting Star Candlestick Pattern

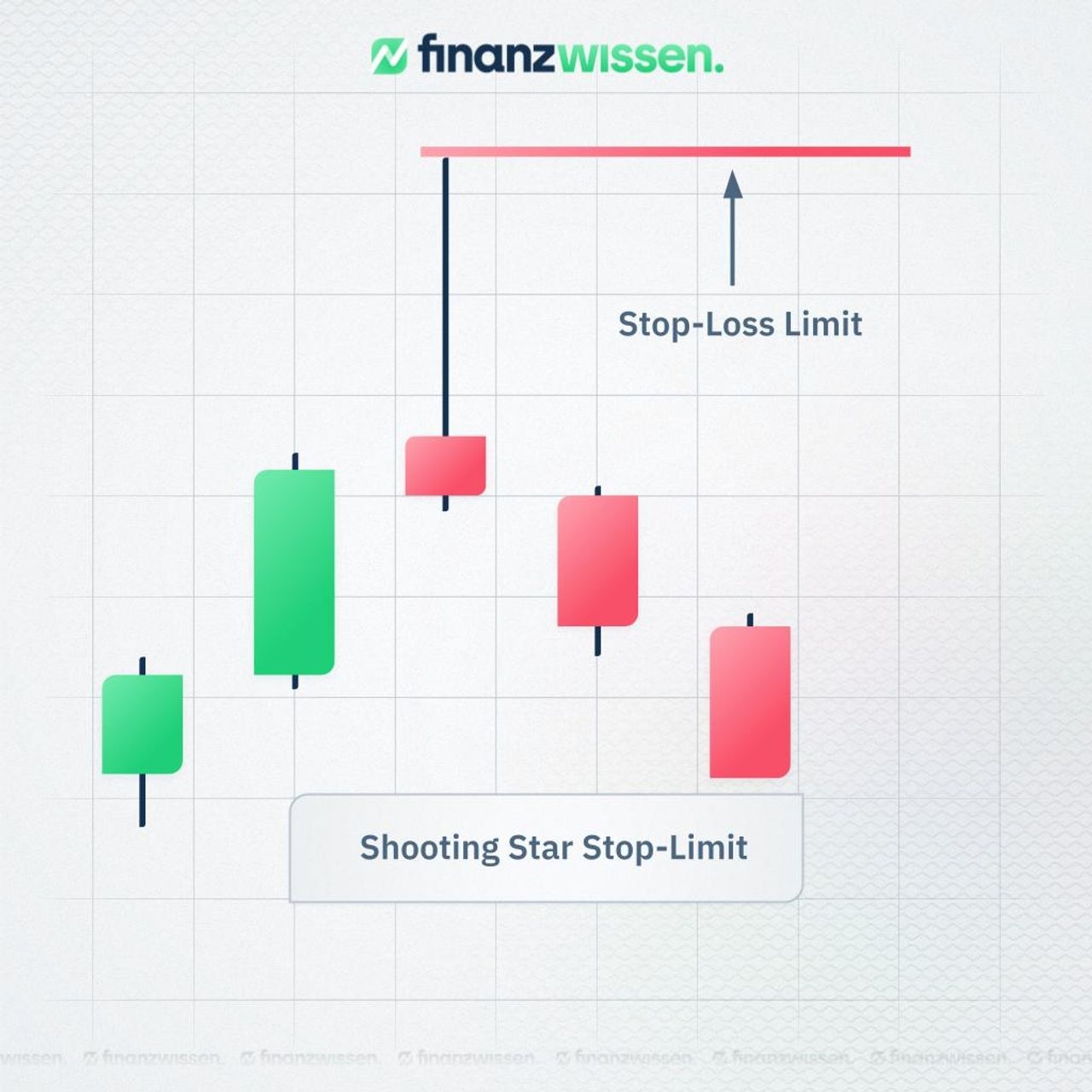

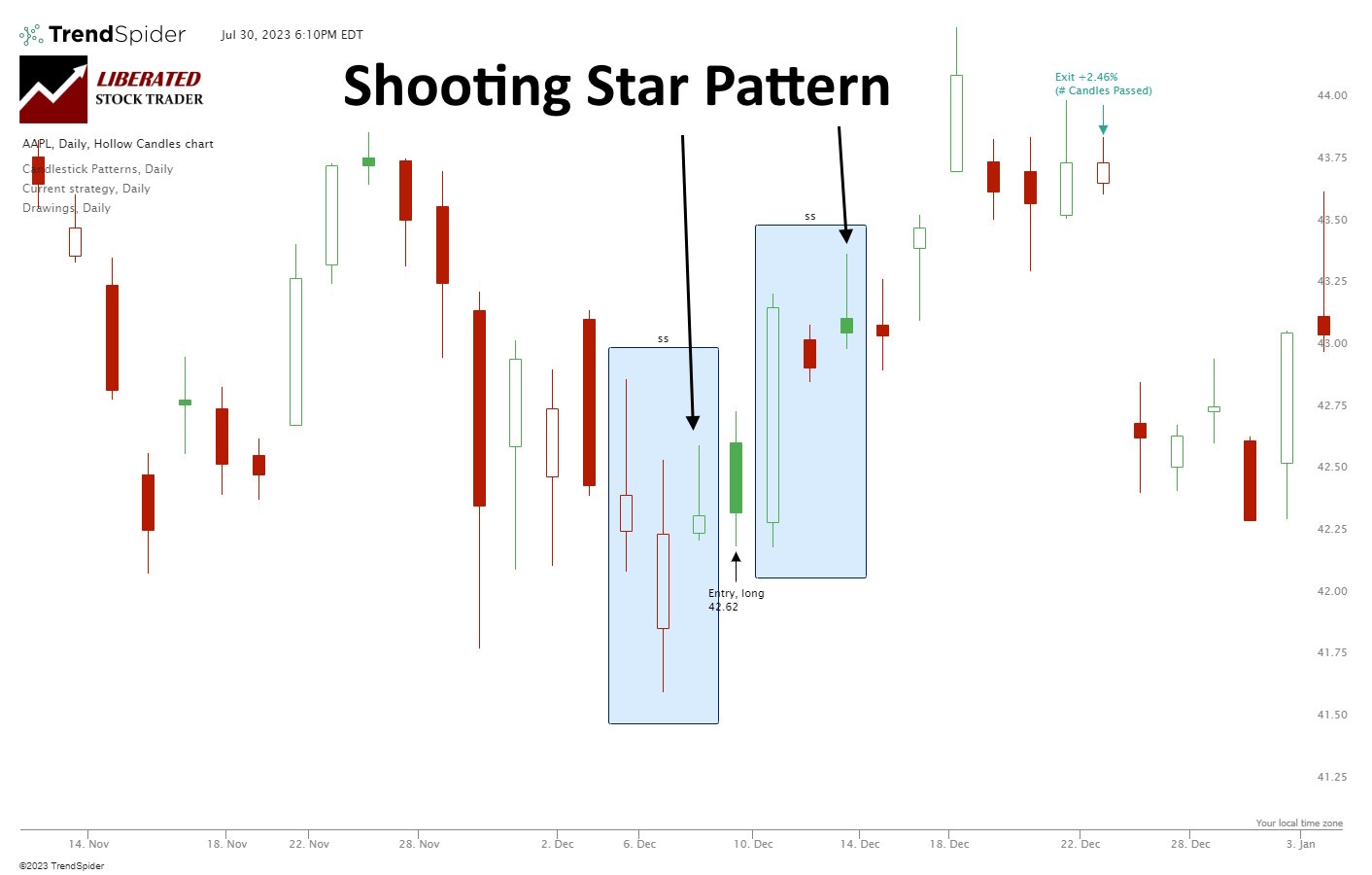

When you see a shooting star candlestick pattern form after an uptrend, it could signal that the trend is losing momentum and a possible reversal to a downtrend. This pattern is a bearish signal and could be a good indication to consider selling your position or entering a short trade.

It’s essential to look for confirmation signals before making any trading decisions based on the shooting star candlestick pattern. These confirmation signals could include higher trading volume or additional bearish candlestick patterns forming in subsequent sessions.

Remember, no single candlestick pattern should be used in isolation to make trading decisions. Always consider other technical indicators, market conditions, and risk management strategies before executing any trades based on the shooting star candlestick pattern.

In conclusion, the shooting star candlestick pattern is a valuable tool for traders and investors to spot potential trend reversals in the markets. By understanding how this pattern works and using it in conjunction with other analysis techniques, you can make more informed and strategic trading decisions.

Shooting Star Trading Pattern Learn And Identify Bearish Opportunities

I Test 1 680 Shooting Star Candle Trades Is It Profitable

What Is A Shooting Star Candlestick Pattern How To Trade It Axi

Shooting Star Pattern Basics And Trading Approaches Market Pulse

Shooting Star Candlestick What You Need To Know