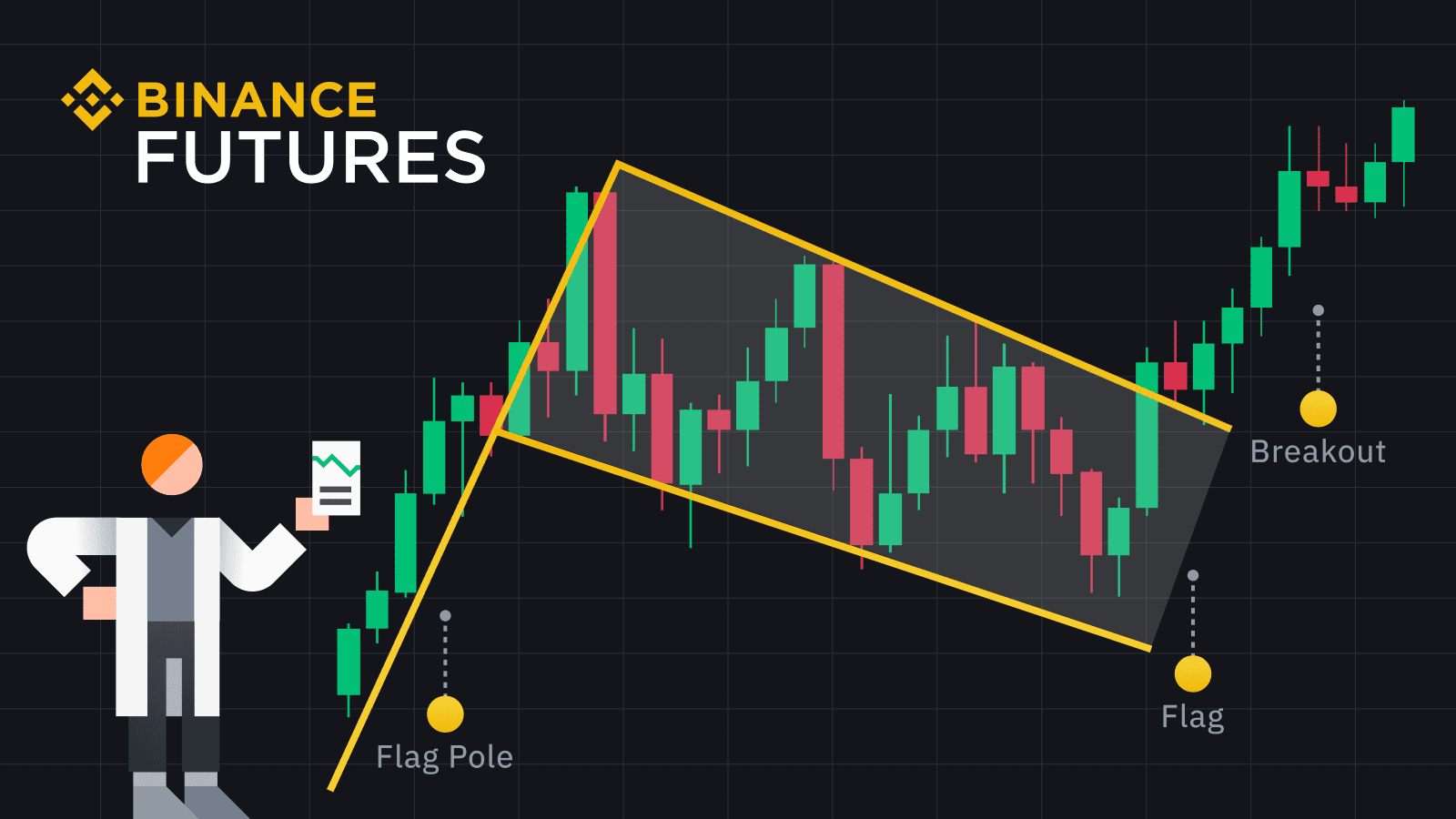

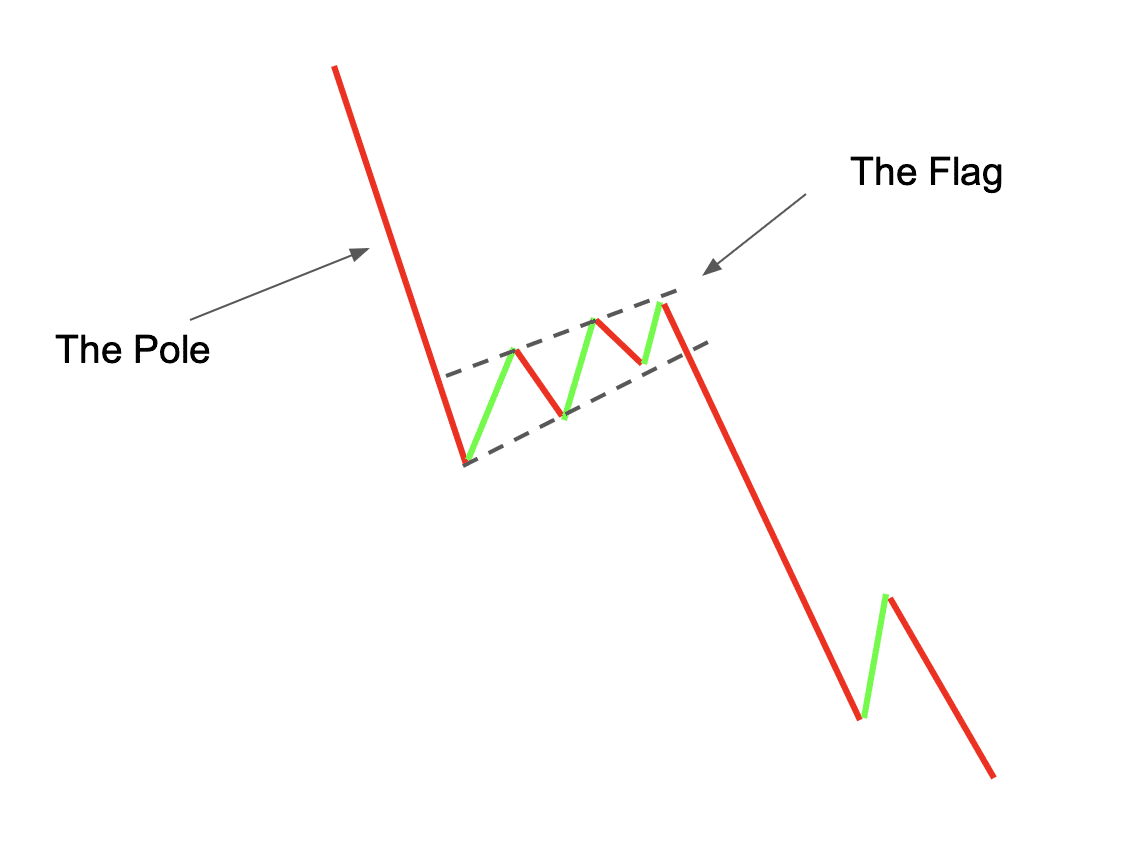

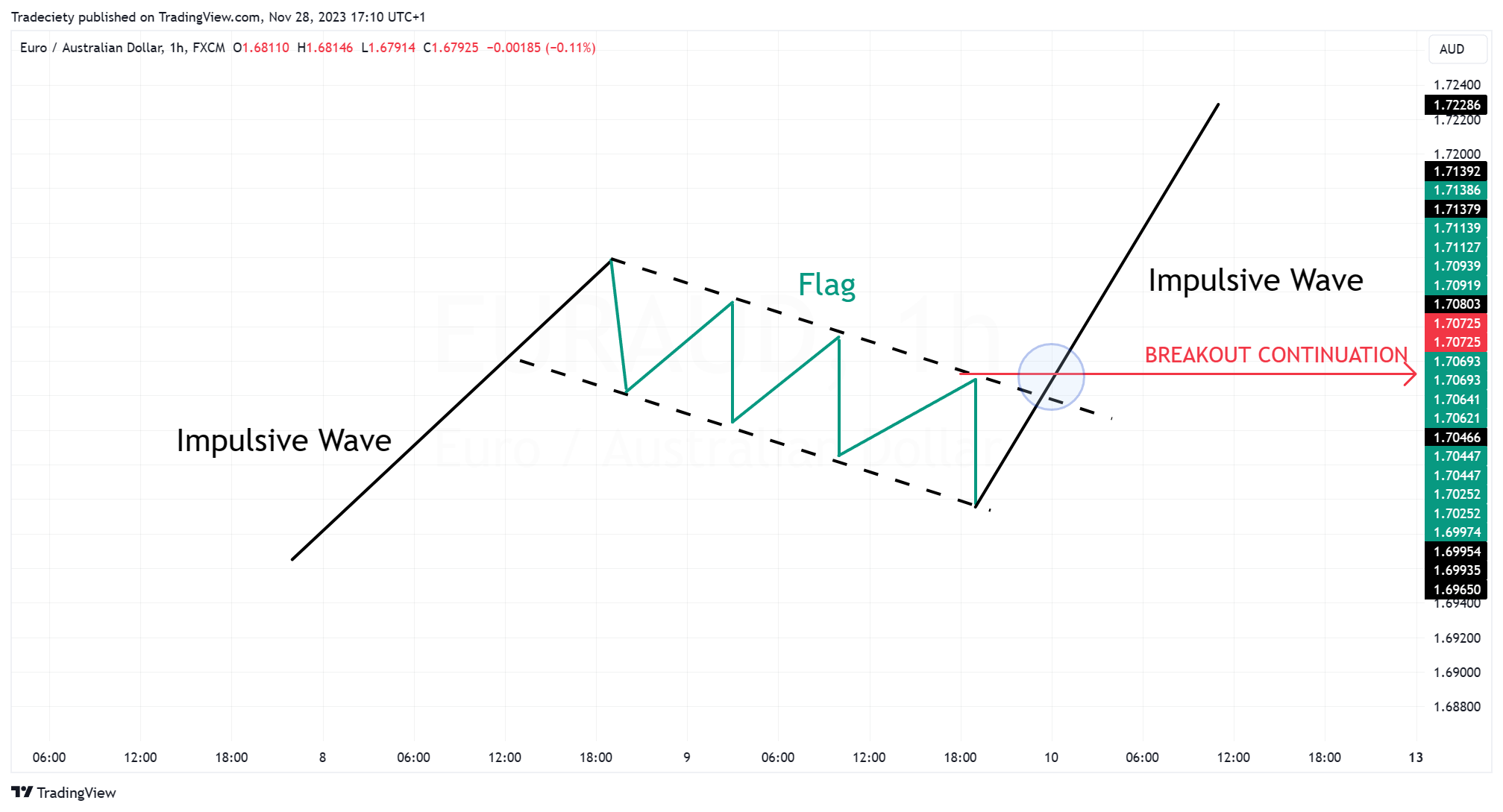

Have you heard of the bear flag trading pattern? It’s a common technical analysis tool used by traders to predict potential price movements in the stock market. This pattern is formed when there is a sharp decline in price followed by a period of consolidation.

During the consolidation phase, the price typically trades in a sideways or slightly upward direction, forming a flag-like shape. Once the pattern is complete, traders look for a breakout below the consolidation level, indicating a potential continuation of the downtrend.

bear flag trading pattern

The Bear Flag Trading Pattern: A Closer Look

Traders often use the bear flag pattern to identify potential short-selling opportunities in the market. By understanding the psychology behind this pattern, traders can capitalize on downward price movements and make profitable trades.

It’s important to note that not all bear flag patterns result in a successful trade. Like any technical analysis tool, it’s essential to combine the bear flag pattern with other indicators and risk management strategies to increase the probability of a successful trade.

As with any trading strategy, it’s crucial to practice proper risk management and only trade with money you can afford to lose. The bear flag trading pattern is just one tool in a trader’s toolbox, and using it effectively requires practice, patience, and discipline.

In conclusion, the bear flag trading pattern is a valuable tool for traders looking to profit from downward price movements in the market. By understanding how this pattern works and incorporating it into your trading strategy, you can increase your chances of success in the stock market.

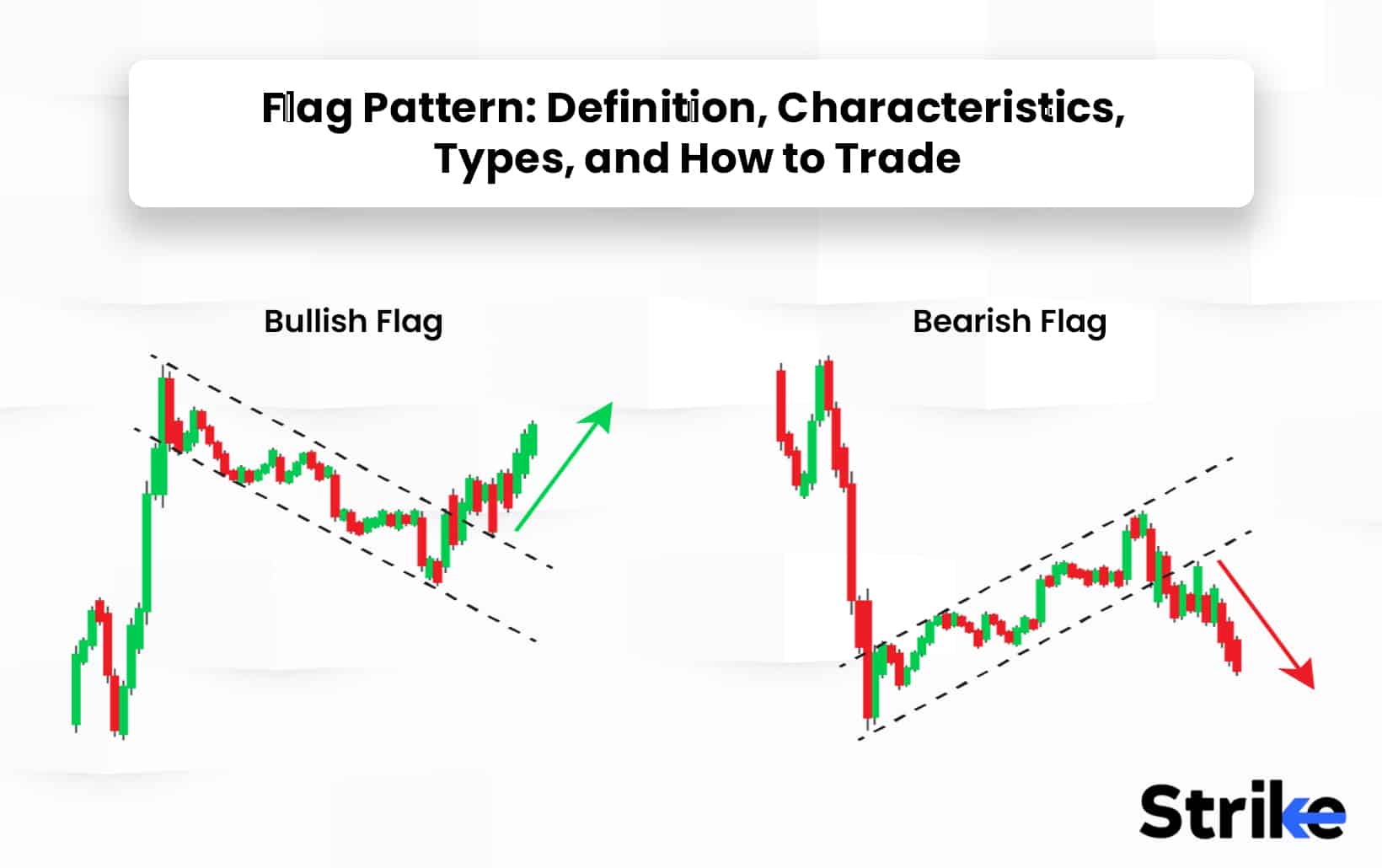

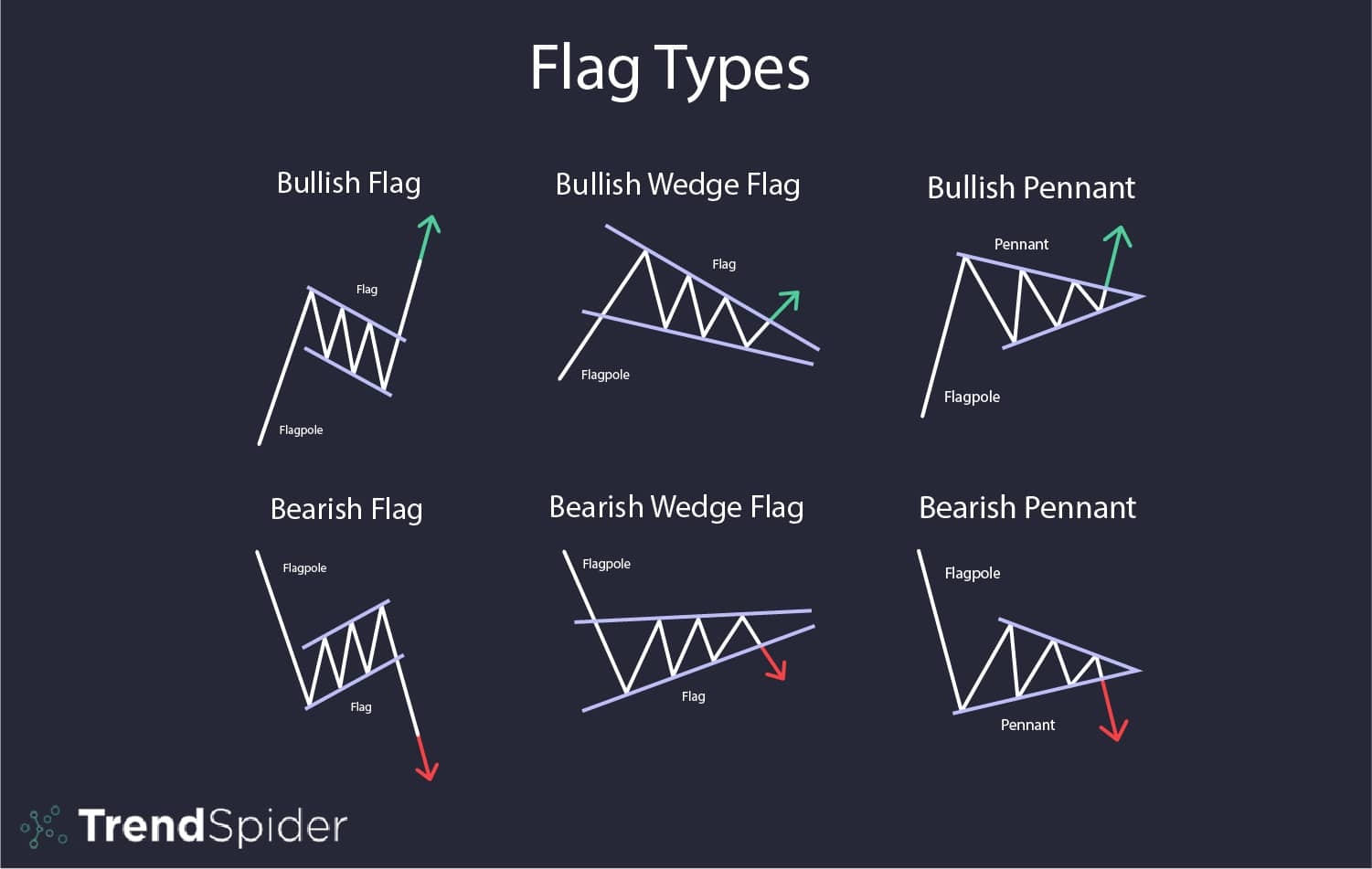

Flag Pattern Definition Types And How To Trade

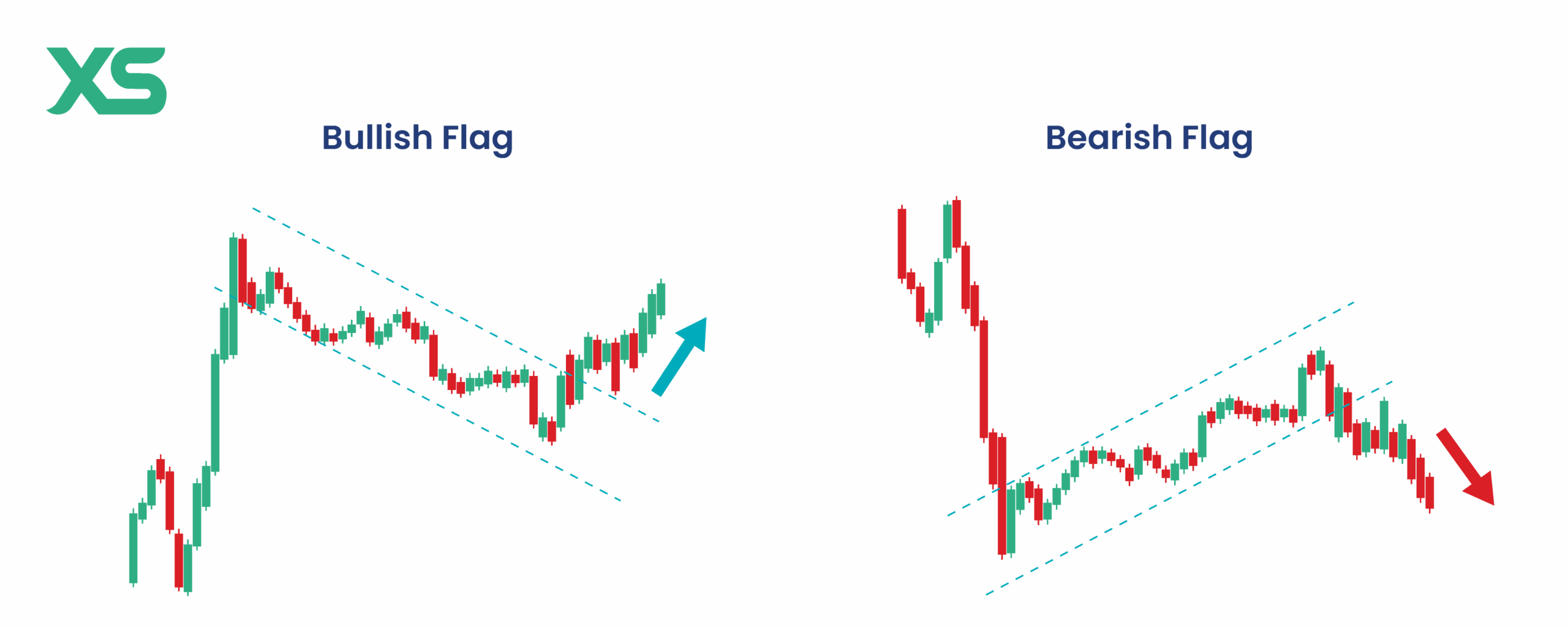

Bear Flag Pattern How To Identify And Trade Successfully XS

What Is A Bear Flag Pattern

Chart Patterns Flags TrendSpider Learning Center

Bull Flag And Bear Flag Trading Explained