Are you looking to enhance your trading skills and stay ahead of the game? Understanding candlestick patterns is a key component of successful trading. These visual cues can help you predict market movements and make informed decisions.

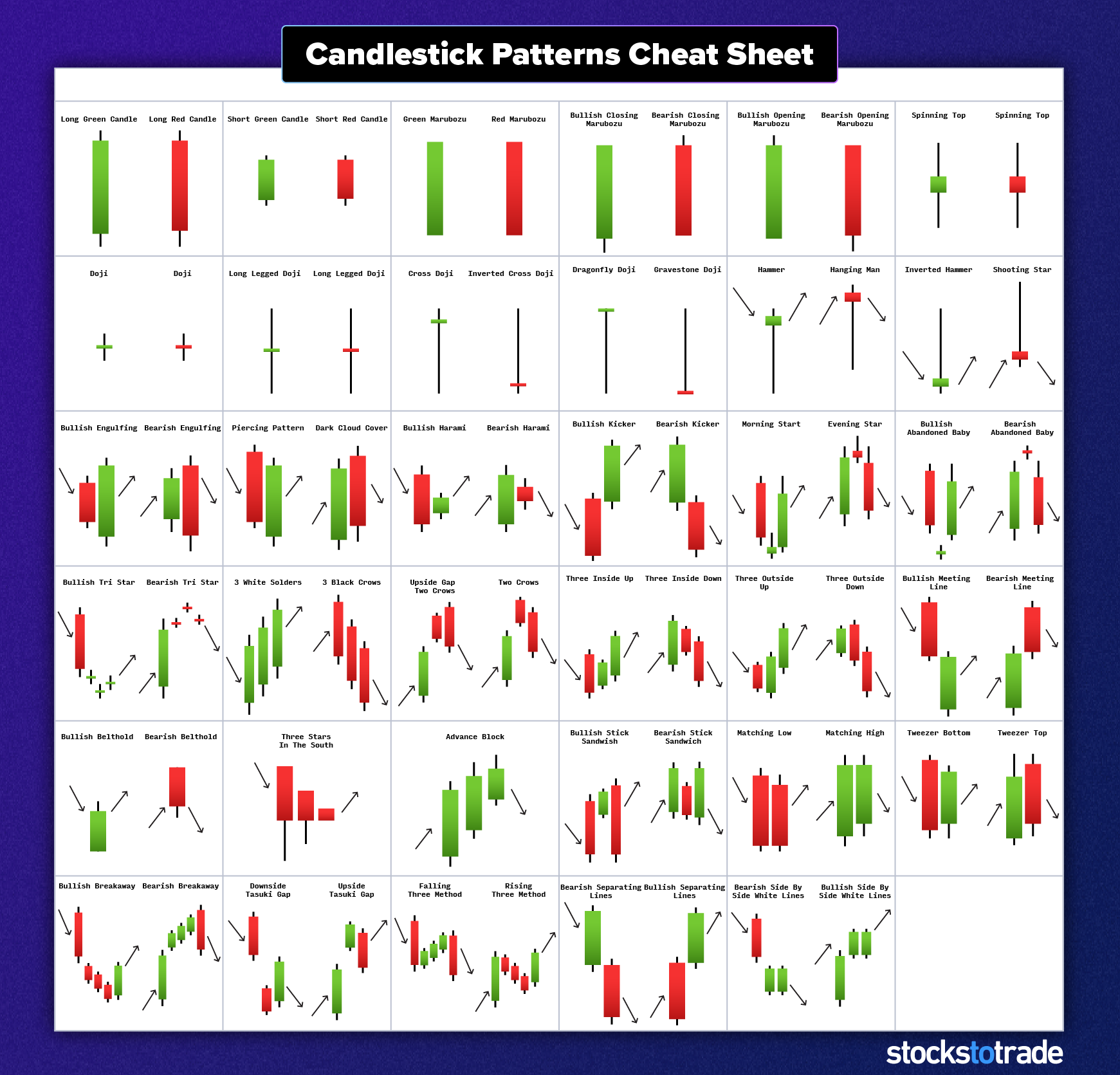

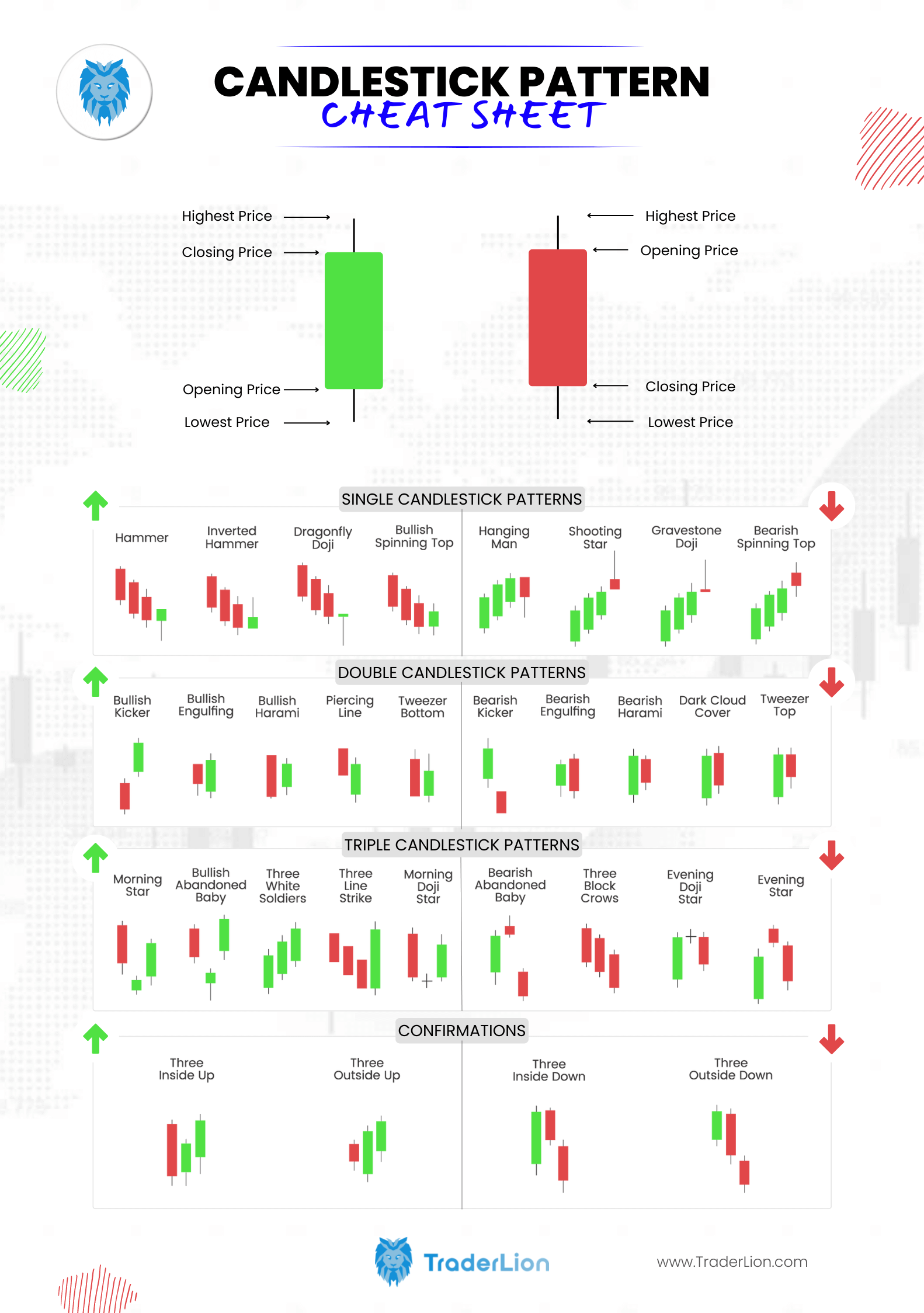

Whether you’re a novice or an experienced trader, having a handy reference like a candlestick patterns cheat sheet can be incredibly beneficial. This cheat sheet provides a quick and easy way to identify different patterns and what they signify in the market.

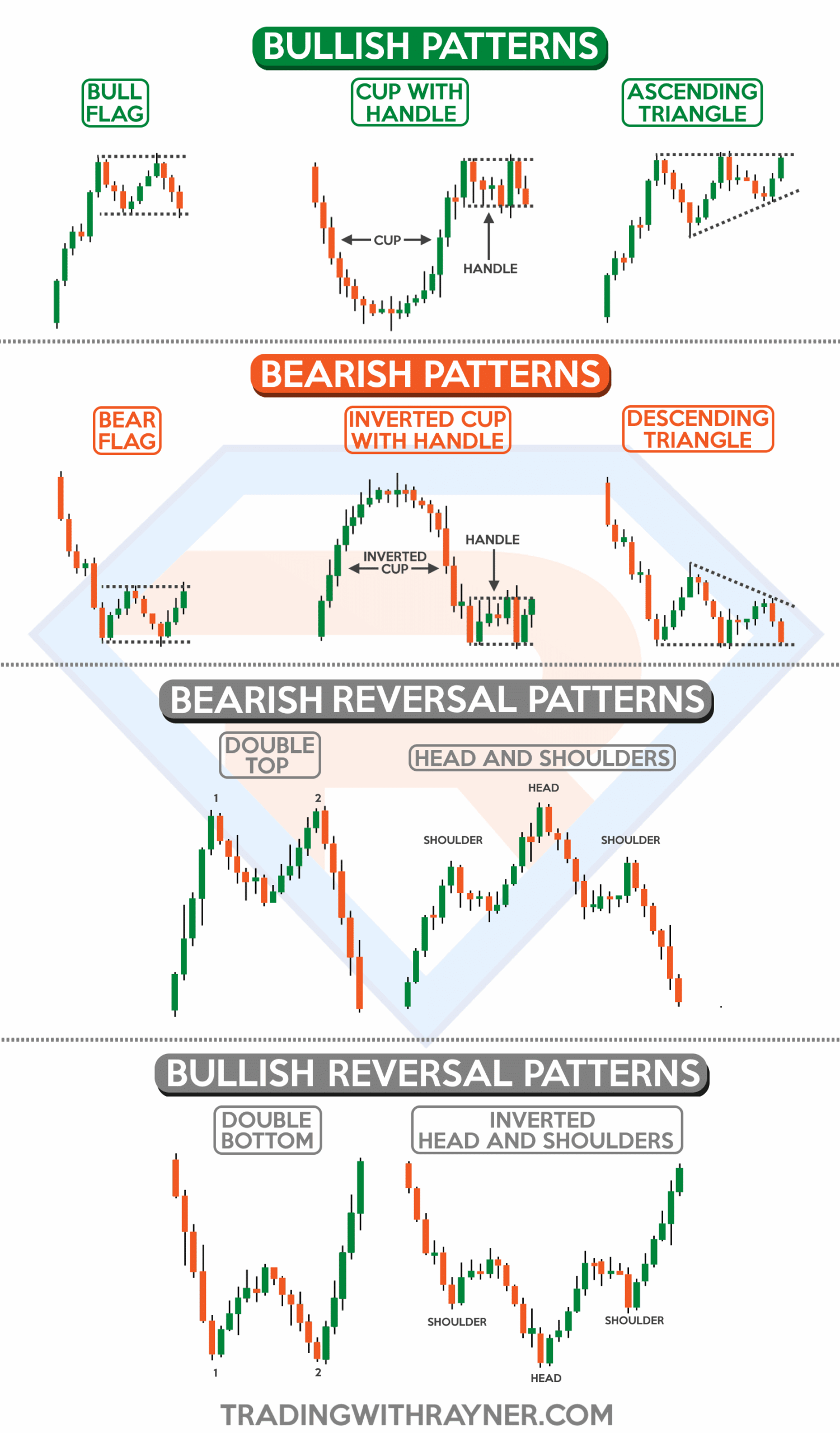

candlestick patterns cheat sheet

Candlestick Patterns Cheat Sheet

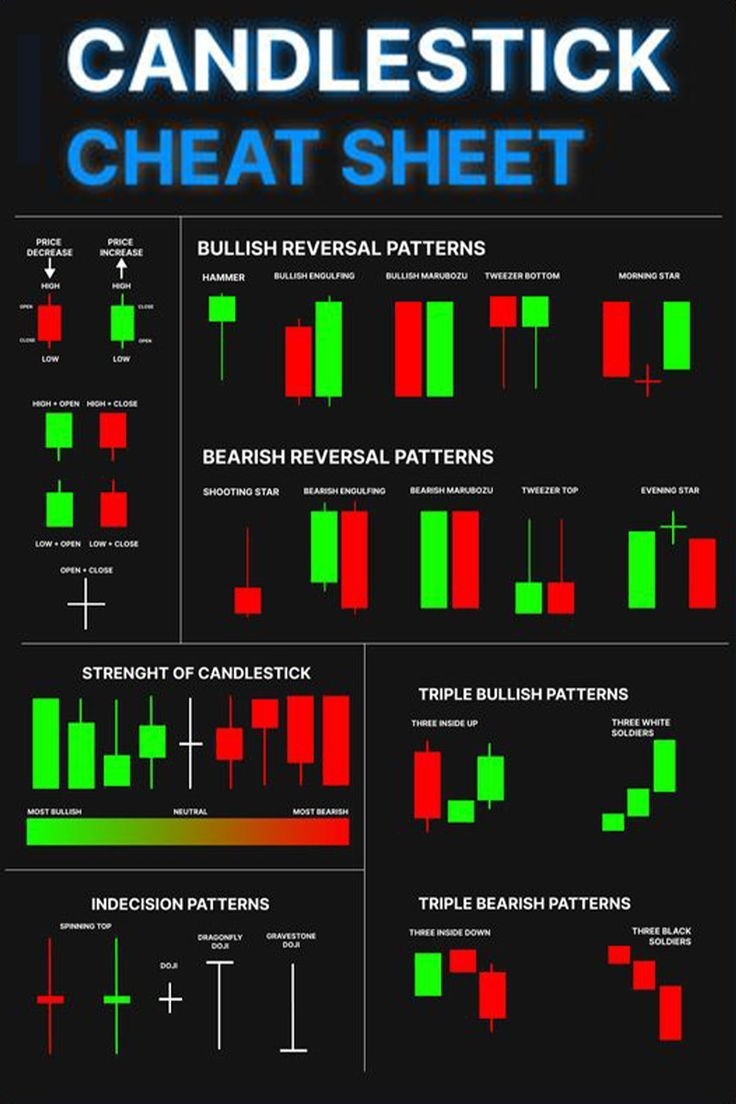

One of the most common patterns on the cheat sheet is the Doji, which indicates market indecision. This pattern occurs when the opening and closing prices are virtually the same, signaling a potential reversal in the market.

Another important pattern to look out for is the Hammer, which appears at the bottom of a downtrend. This bullish reversal pattern suggests that buyers are starting to outnumber sellers, potentially leading to a price increase.

On the flip side, the Hanging Man pattern is the bearish counterpart to the Hammer. This pattern occurs at the top of an uptrend and suggests a possible reversal in the market, with sellers starting to gain control.

By familiarizing yourself with these and other candlestick patterns on the cheat sheet, you can improve your trading strategies and make more informed decisions. Remember, practice makes perfect, so don’t hesitate to test your knowledge and refine your skills.

Next time you’re analyzing the markets, keep your candlestick patterns cheat sheet handy. With a little practice and patience, you’ll soon become a master at interpreting these visual cues and maximizing your trading potential.

Candlestick Cheat Sheet

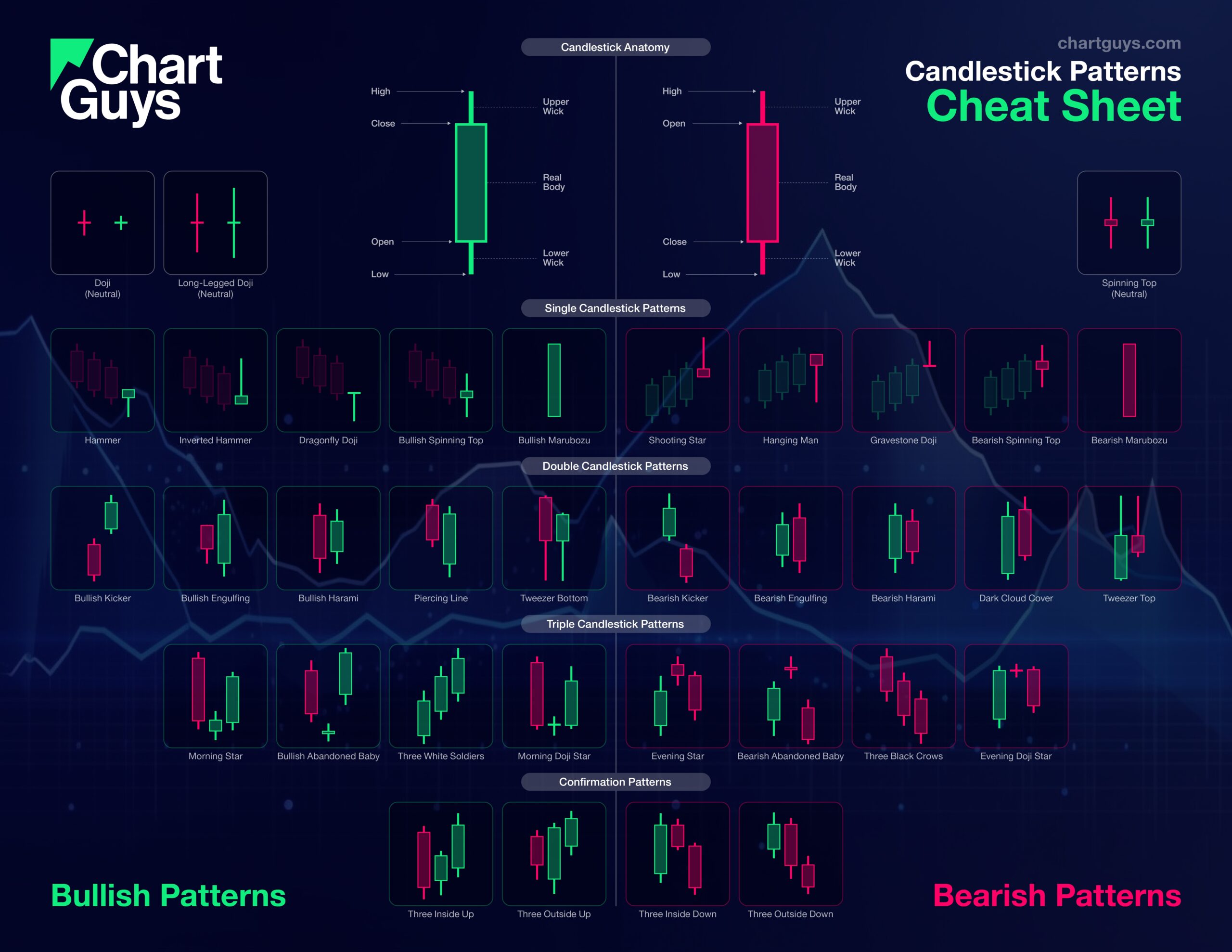

Free Candlestick Patterns PDF Chart Guys

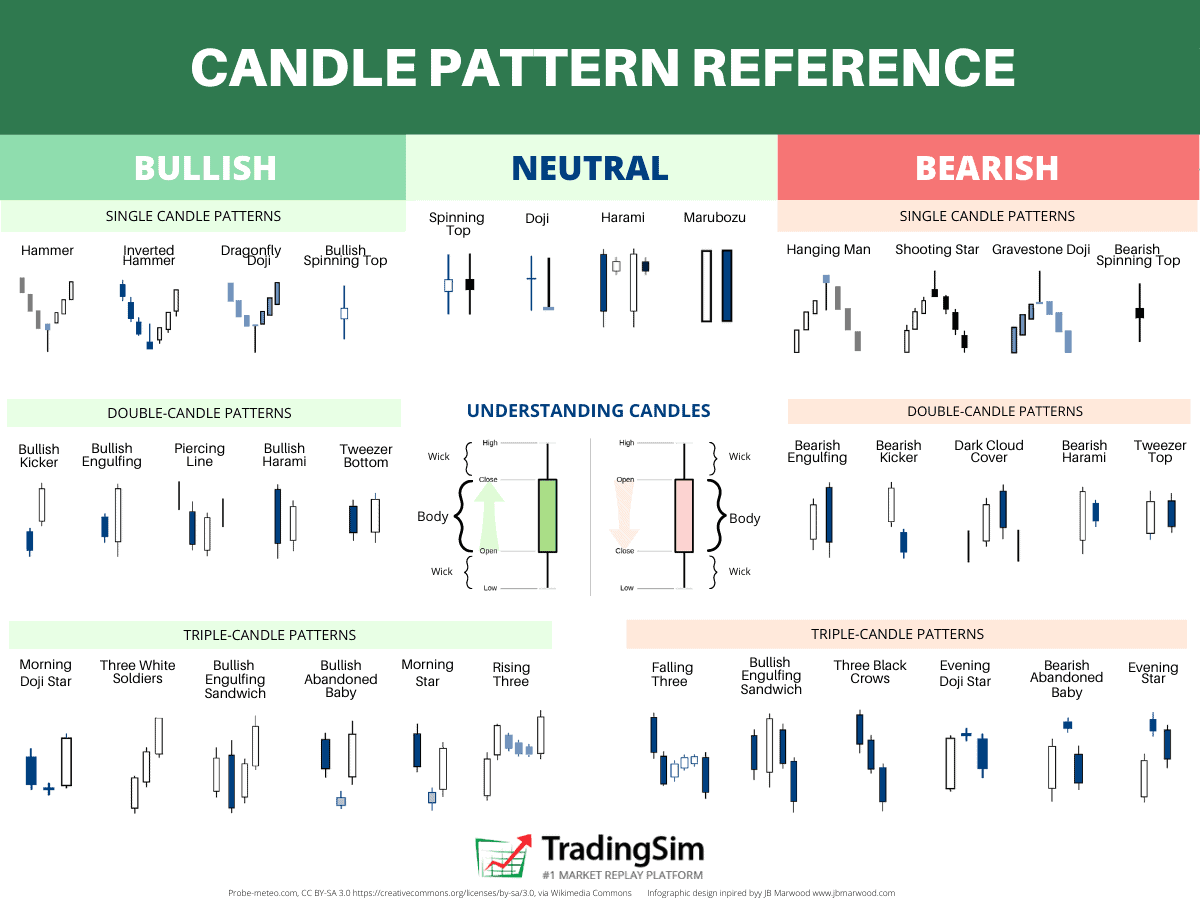

Candlestick Patterns Explained Plus Free Cheat Sheet TradingSim

Candlestick Charts Definition Interpretation

Candlestick Patterns The Ultimate Cheat Sheet TraderLion