Are you looking to improve your trading skills and learn about different chart patterns? If so, you’ve come to the right place! Chart patterns are essential tools for technical analysis in the world of trading. One popular pattern that traders often use is the double top chart pattern.

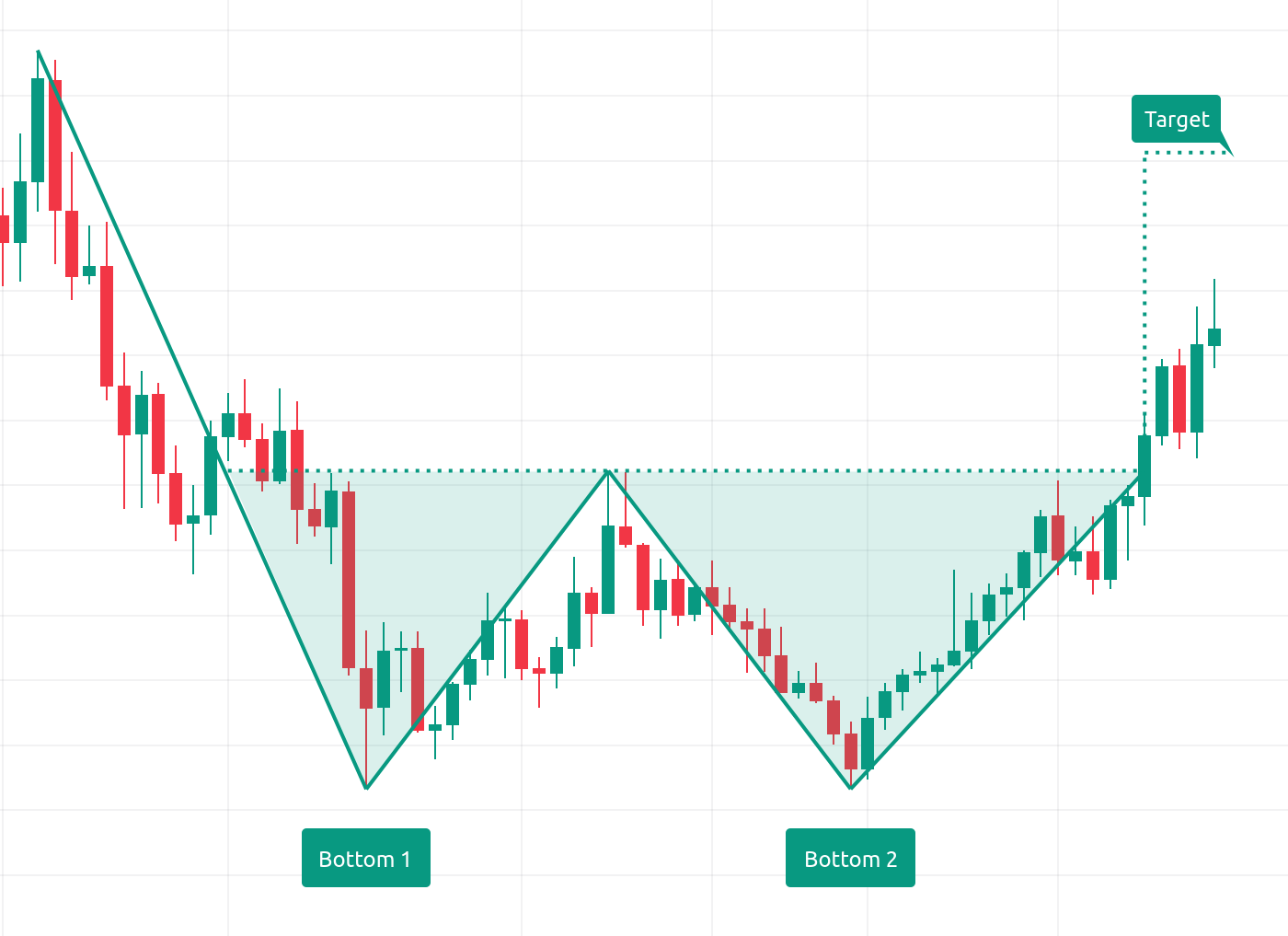

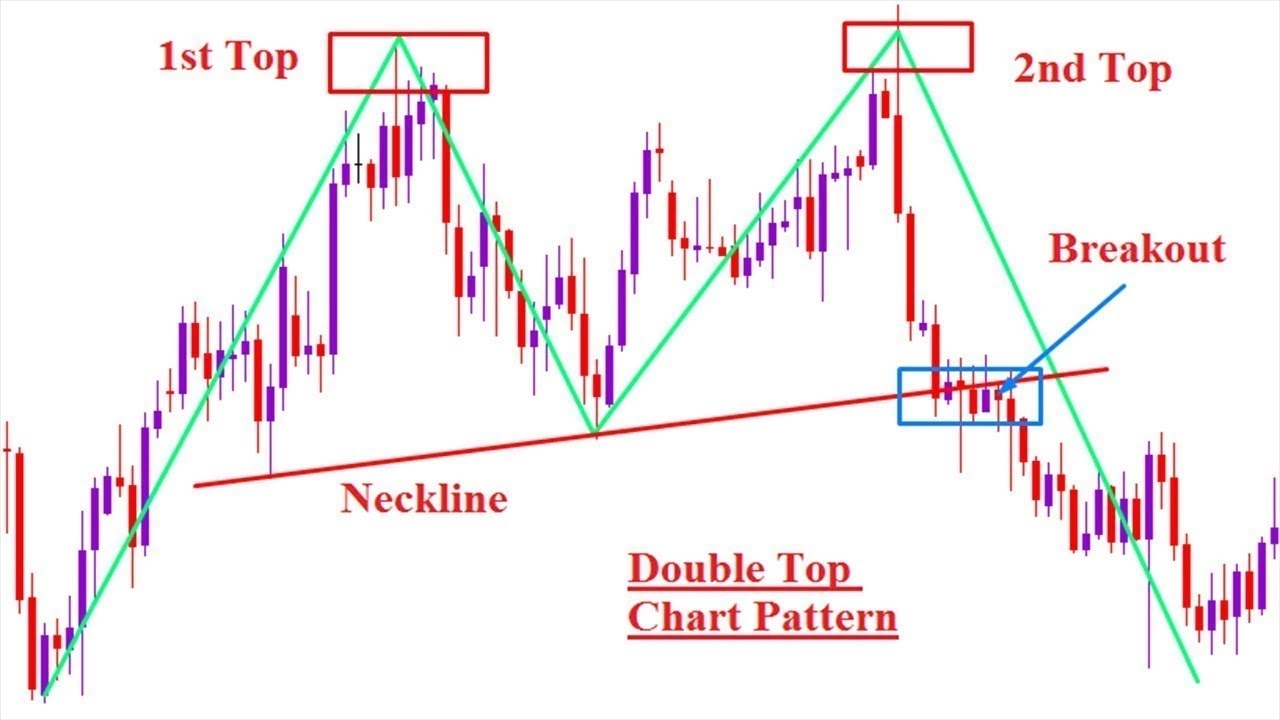

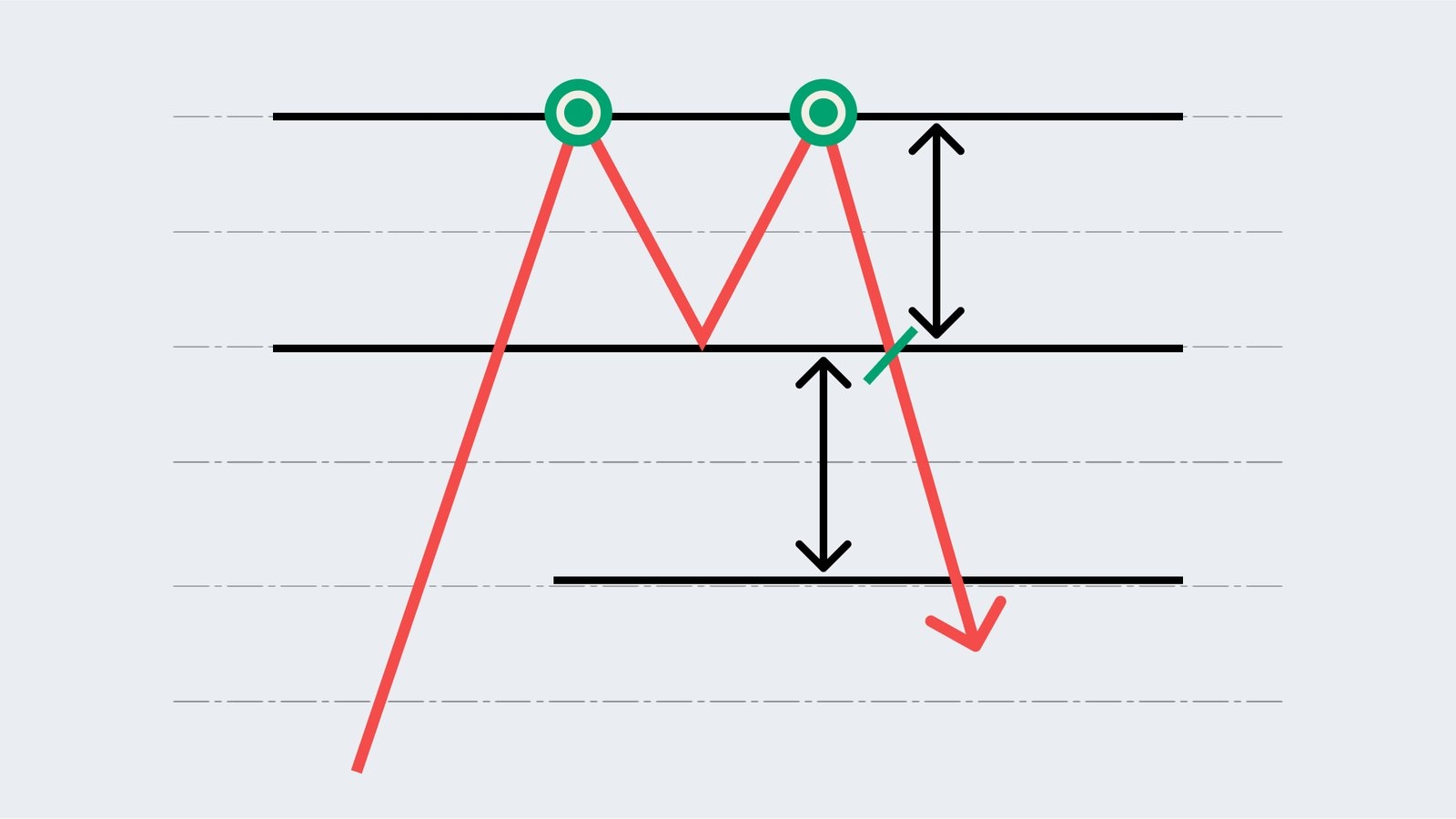

The double top chart pattern is a bearish reversal pattern that signals an upcoming downtrend in the market. It consists of two peaks at approximately the same price level, followed by a price decline. This pattern indicates that the market is losing its bullish momentum and is likely to reverse direction.

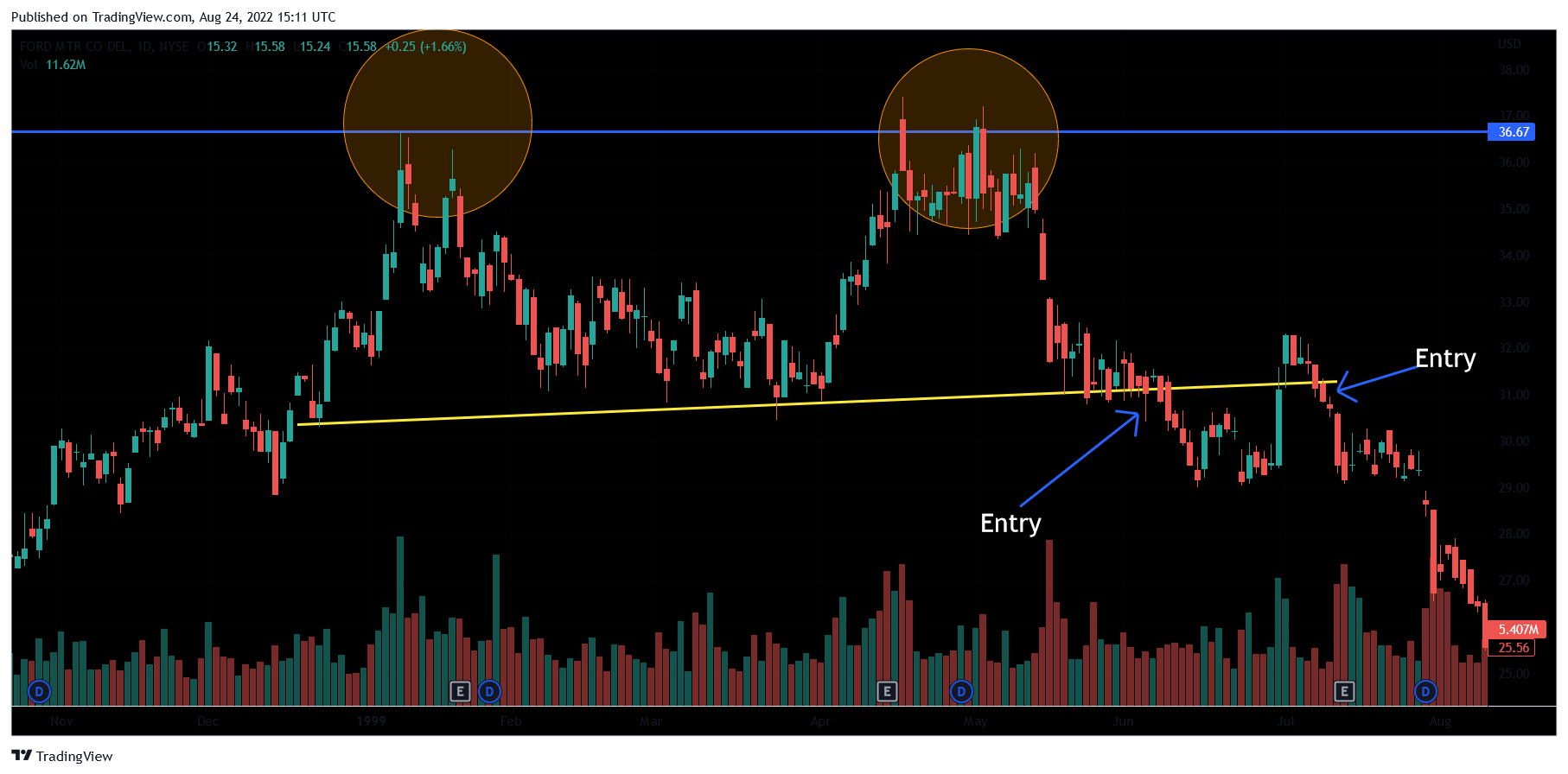

double top chart pattern

Understanding the Double Top Chart Pattern

Traders typically look for the double top chart pattern when analyzing price charts. They use this pattern to identify potential entry and exit points for their trades. When they spot a double top pattern forming, they may consider selling their positions or opening short positions to capitalize on the expected downward movement.

It’s essential to wait for confirmation of the pattern before making any trading decisions. Confirmation typically occurs when the price breaks below the neckline, which connects the lows of the two peaks. This breakout confirms the validity of the pattern and signals a high probability of a downtrend.

Keep in mind that no trading pattern is foolproof, and it’s essential to use other technical indicators and risk management strategies to enhance your trading success. By understanding the double top chart pattern and incorporating it into your trading analysis, you can make more informed decisions and potentially improve your trading results.

Now that you know more about the double top chart pattern, feel free to explore other chart patterns and enhance your trading knowledge. Happy trading!

ICICIdirect

90 Win How To Trade Double Tops Double Bottom Pattern Trading YouTube

Double Top Pattern How To Identify Trade It

What Is A Double Top Chart Pattern How To Trade It Axi

How To Trade The Double Top And Double Bottom Chart Pattern