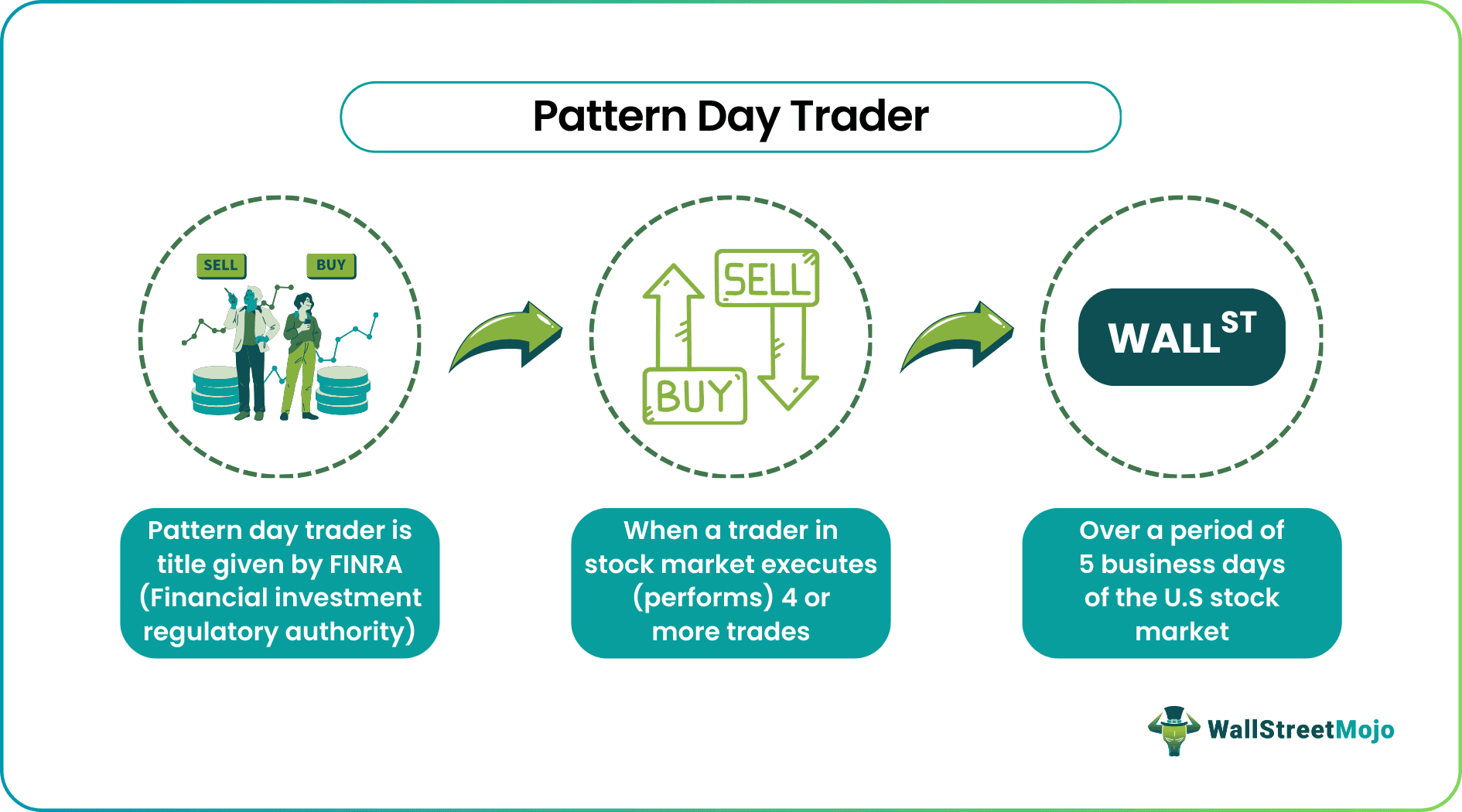

Are you an active trader in the stock market? If so, you may have heard of the pattern day trader rule. This rule is designed to protect traders from excessive risk and requires accounts with less than $25,000 to adhere to certain regulations.

Essentially, the pattern day trader rule states that if you make four or more day trades within a five-day period, you will be considered a pattern day trader. Once classified as such, you are required to maintain a minimum balance of $25,000 in your trading account.

pattern day trader rule

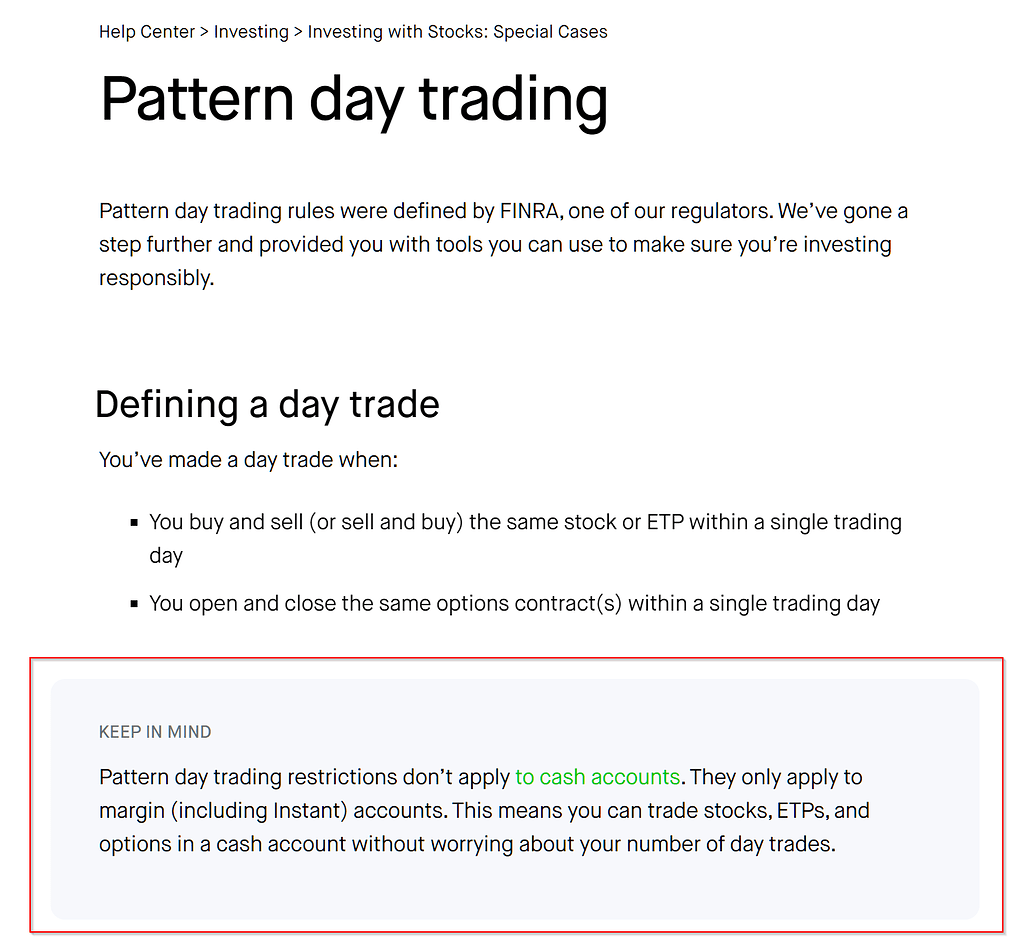

The Impact of the Pattern Day Trader Rule

For traders who fall under this rule, it can be both a blessing and a curse. While the $25,000 minimum balance can be a barrier for some, it also serves as a protective measure to prevent traders from taking on too much risk without the proper capital.

One way to avoid being classified as a pattern day trader is to limit your day trading activity to three or fewer trades per week. This can help you stay below the threshold set by the rule and avoid the restrictions that come with being labeled a pattern day trader.

Overall, the pattern day trader rule is in place to promote responsible trading practices and protect traders from potentially devastating losses. By understanding and following the guidelines set forth by this rule, you can navigate the stock market with confidence and reduce your risk exposure.

In conclusion, while the pattern day trader rule may seem restrictive to some, it ultimately serves to safeguard traders and promote a more stable trading environment. By adhering to the regulations and maintaining the required minimum balance, you can continue to engage in day trading with peace of mind.

Cash Account To Avoid Pattern Day Trading Rule Getting Started With Alpaca Alpaca Community Forum

Pattern Day Trader What Is It Rule Examples Pros Cons

Pattern Day Trading The Pattern Day Trading Rule ClayTrader

Cash Account To Avoid Pattern Day Trading Rule Getting Started With Alpaca Alpaca Community Forum

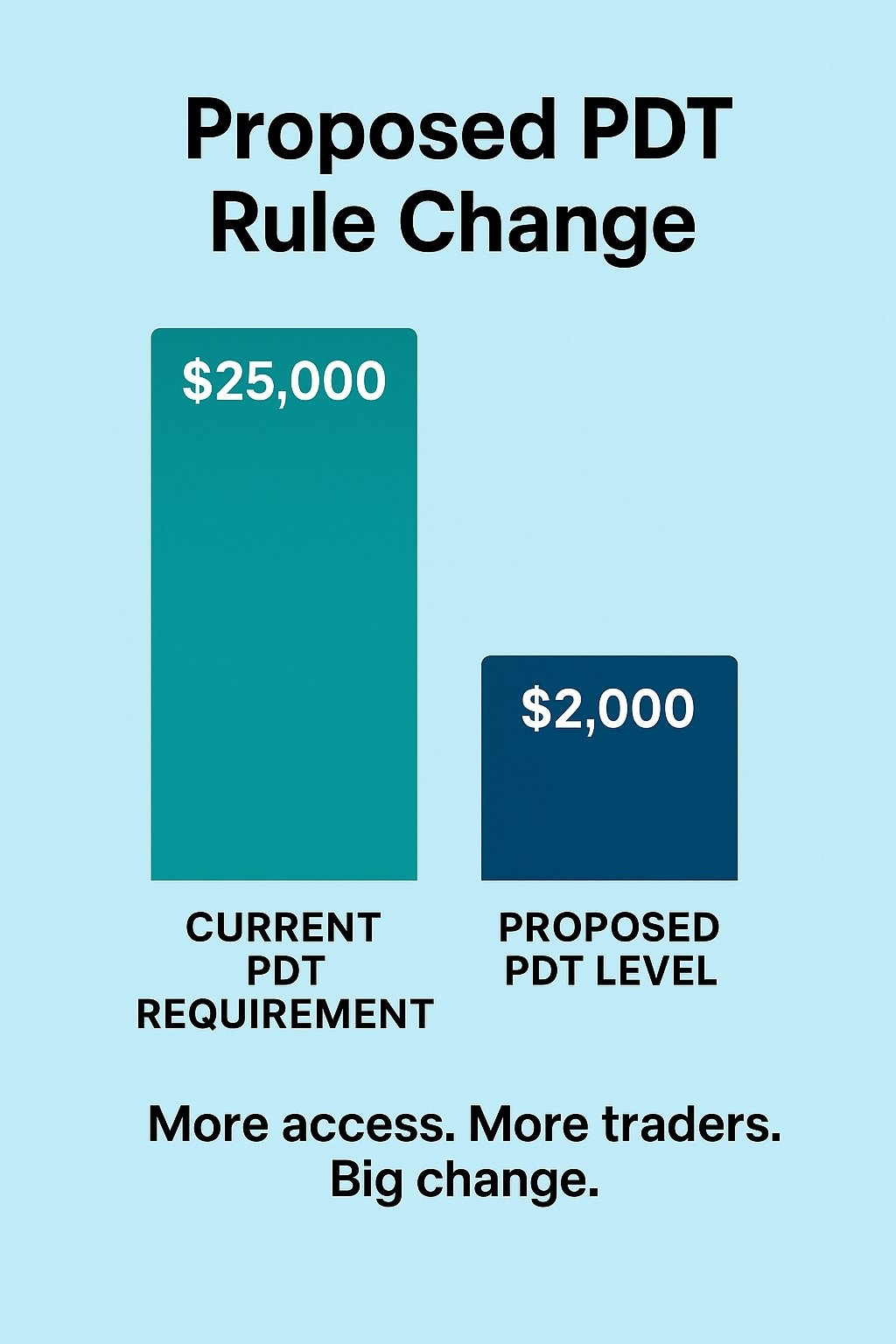

PDT Rule On The Brink Of Historic Overhaul Potentially Lowering Entry For Day Traders Cyber Trading University