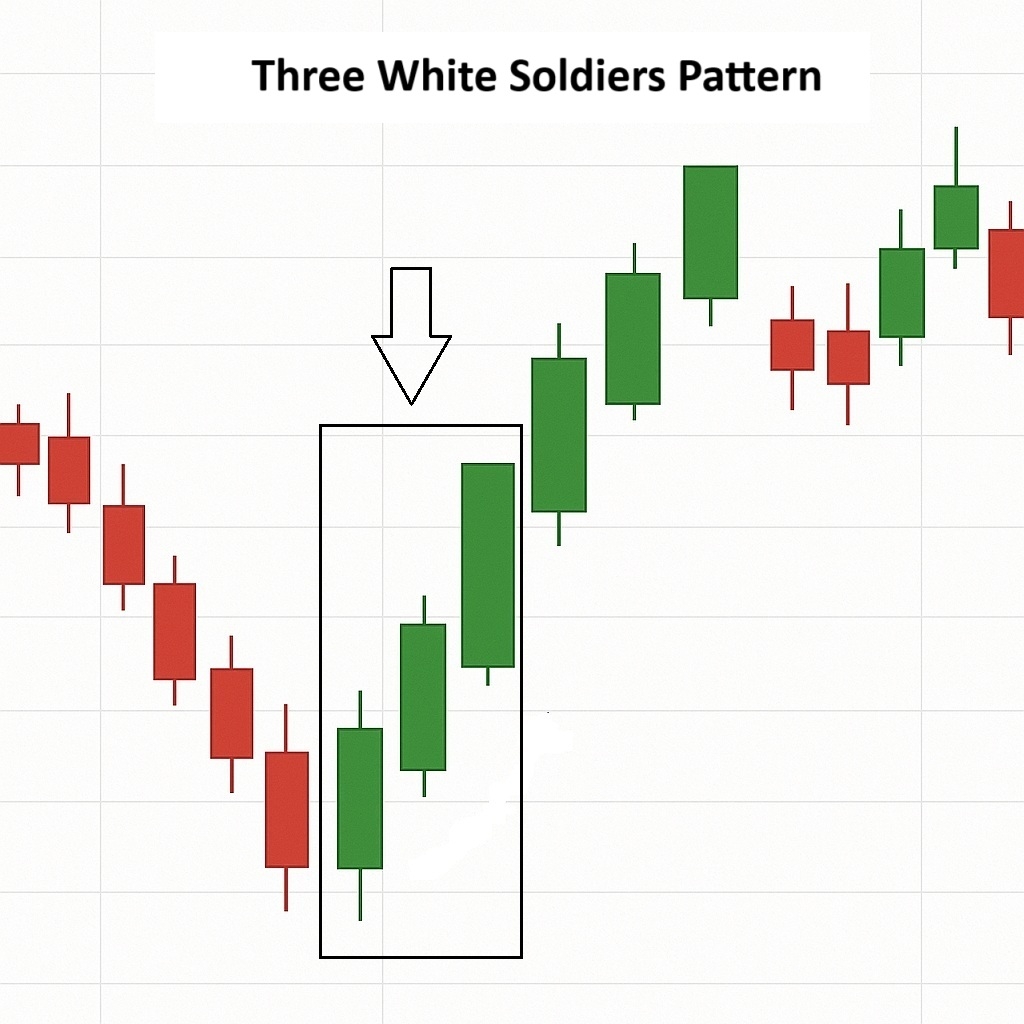

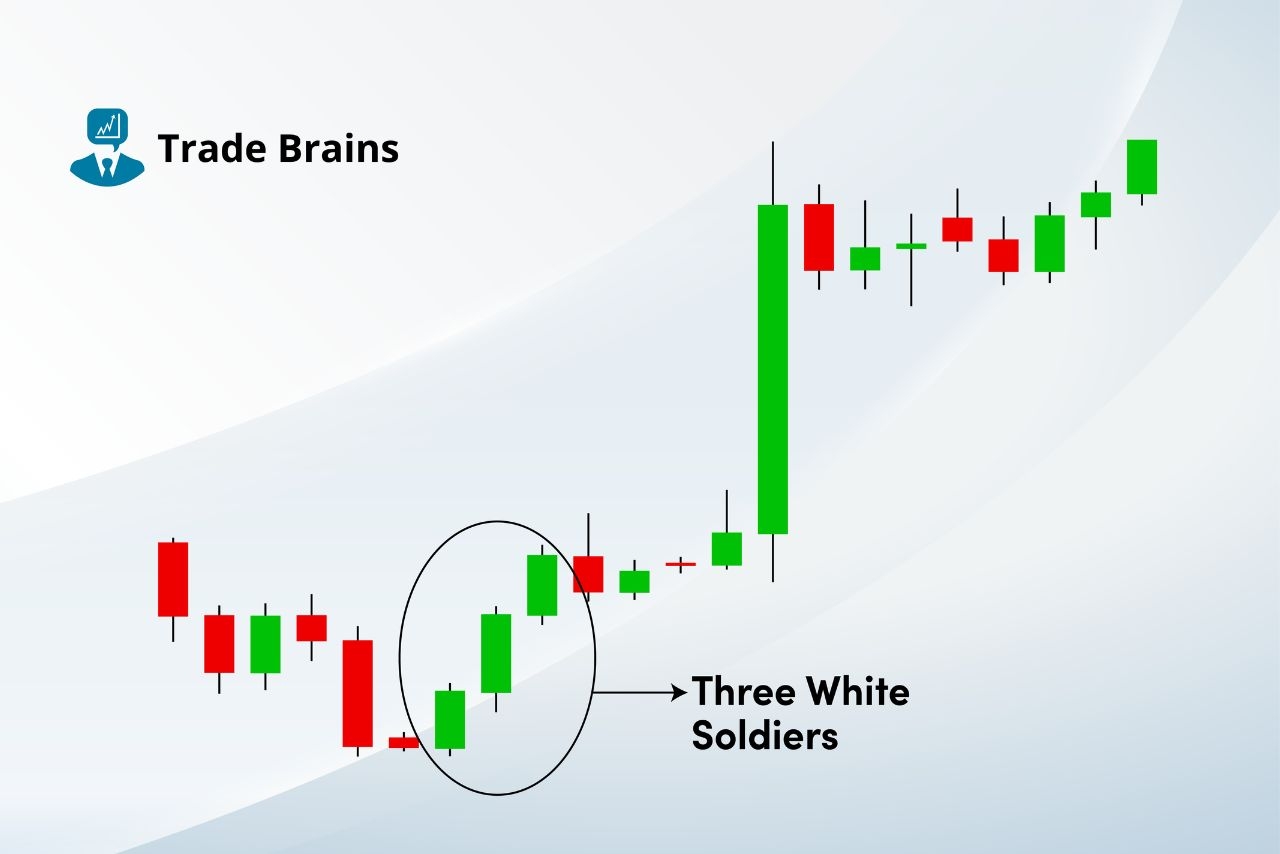

Are you interested in learning more about candlestick patterns in trading? One popular pattern that traders often look for is the “three white soldiers” pattern. This pattern can indicate a potential bullish reversal in the market.

When three consecutive bullish candles with long bodies appear after a downtrend, it forms the “three white soldiers” pattern. This pattern suggests that buyers have taken control and that the price may continue to rise.

three white soldiers candlestick pattern rules

Three White Soldiers Candlestick Pattern Rules

1. Look for three consecutive bullish candles with long bodies.

2. These candles should open higher than the previous candle’s close.

3. Each candle should close near its high, showing strong buying pressure.

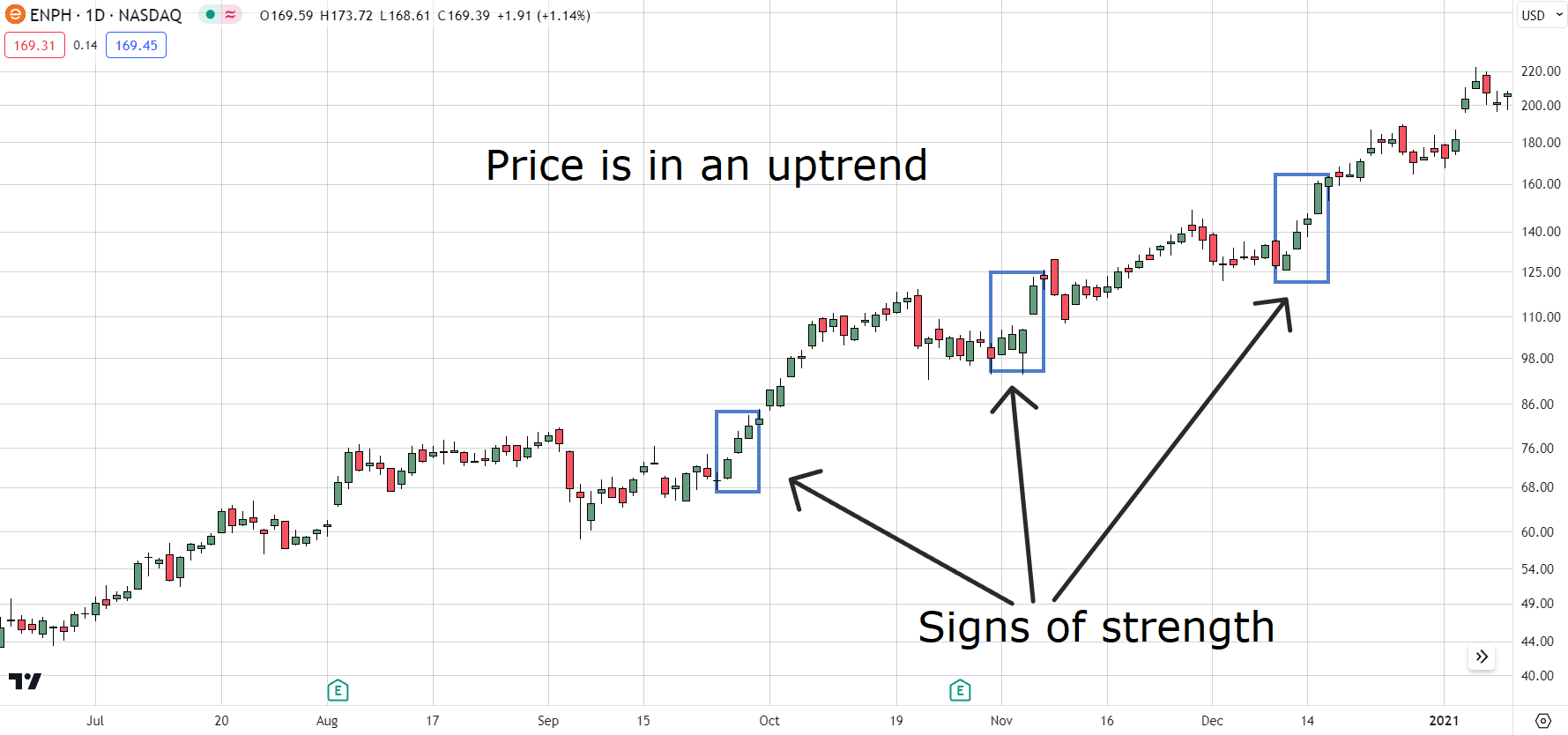

4. The pattern is more reliable when accompanied by high trading volume.

5. Confirm the pattern with other technical indicators for higher accuracy.

Trading based on candlestick patterns requires practice and experience. It’s essential to combine these patterns with other forms of analysis to make informed decisions. Remember that no pattern is 100% accurate, so always use proper risk management.

By understanding the rules of the “three white soldiers” candlestick pattern, you can potentially identify profitable trading opportunities in the market. Keep practicing, learning, and honing your skills to become a successful trader in the long run.

Three White Soldiers Candlestick Pattern Trading Ideas And More

Three White Soldiers Candlestick Pattern ForexBee

3 White Soldiers 3 Things You Must Consider Before Trading TradingSim

Three White Soldiers Key Characteristics And Strategies Alchemy Markets

Three White Soldiers Candlestick Pattern The Essential Guide